🫀Edwards Lifesciences: the Beating Heart of Innovation

The valve of returns is starting to flow

Edwards is a dominant force in MedTech and the leader in heart valve solutions.

Results reflect it.

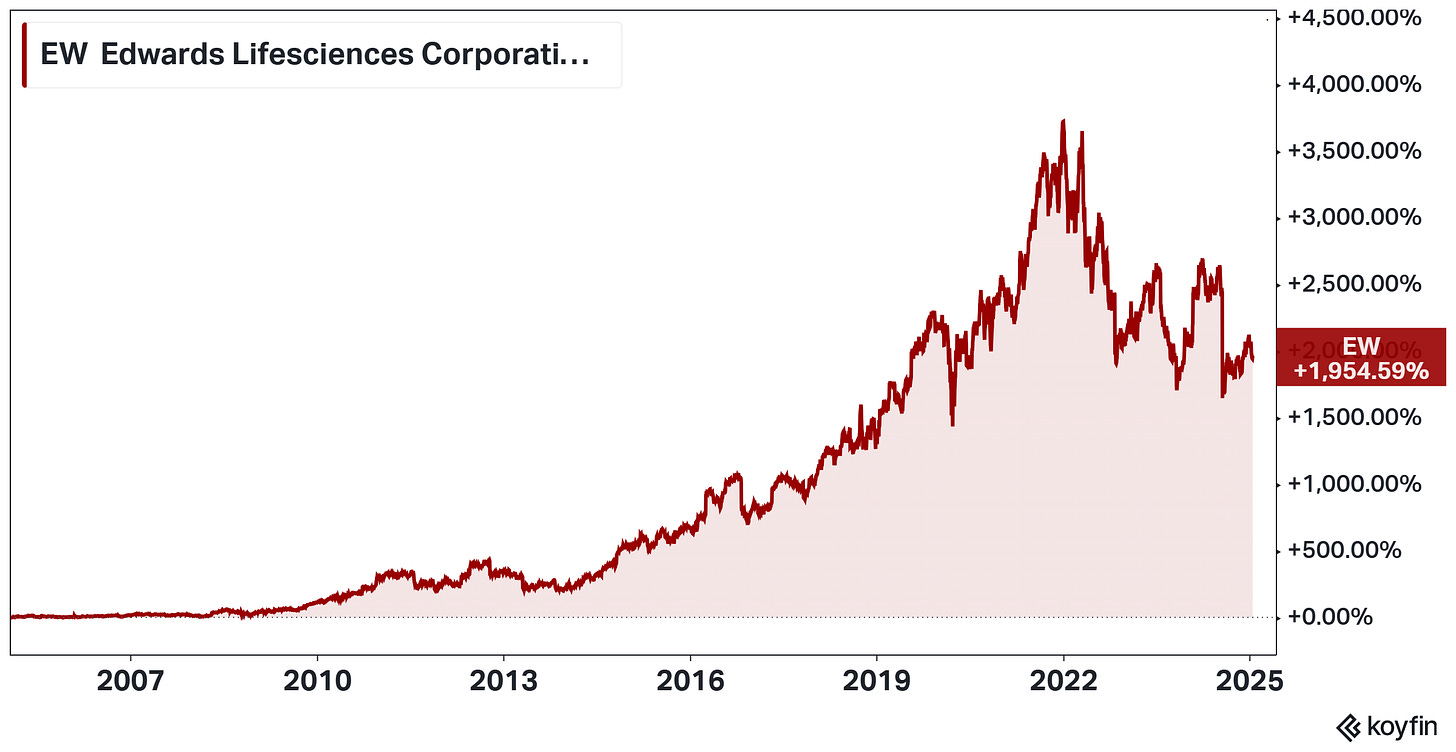

The stock has compounded at an impressive 16% CAGR returns for over 20 years.

However, despite its strong position, the company has entered a transitional phase and has not delivered returns to investors over the past five years.

In this article, we explore why the pessimism is ungrounded and how Edwards is set for double-digit growth in the future.

If you want to stay updated with future articles, please subscribe and support me with a ❤️!

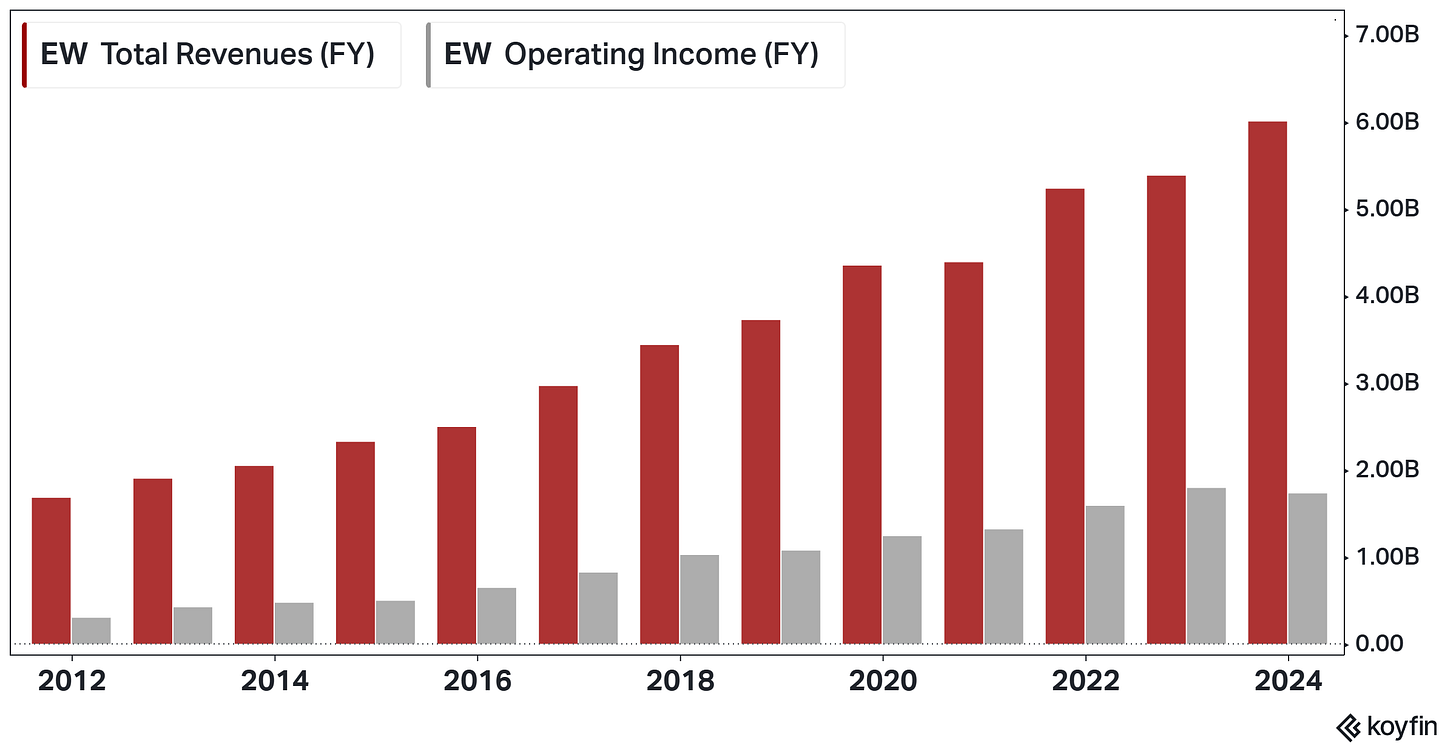

Dominant MedTech just compounds

Over the past 12 years, Revenue and Operating Income have more than tripled, with Operating Margin exceeding 25% during the last years.

Edwards has cemented its dominant position during the last decade by continuously innovating in the heart valve disease space.

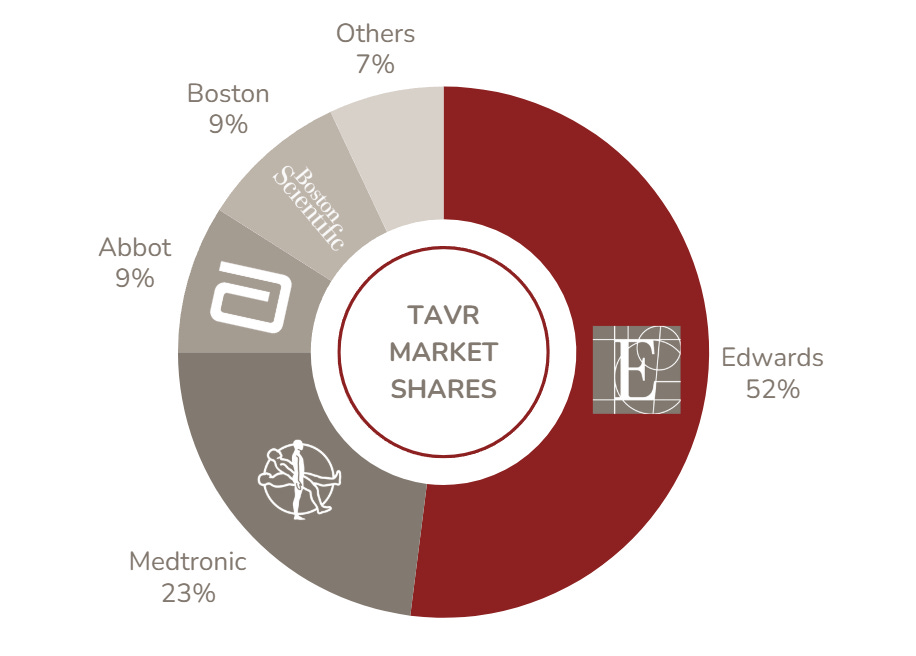

This focus has enabled the company to secure over 50% market share in the $7 billion TAVR segment, which accounts for ~75% of its Revenue.

Niche focus pays off

Edwards has a significant advantage because it focuses solely on the structural heart market, particularly after selling its critical care division to Becton Dickinson.

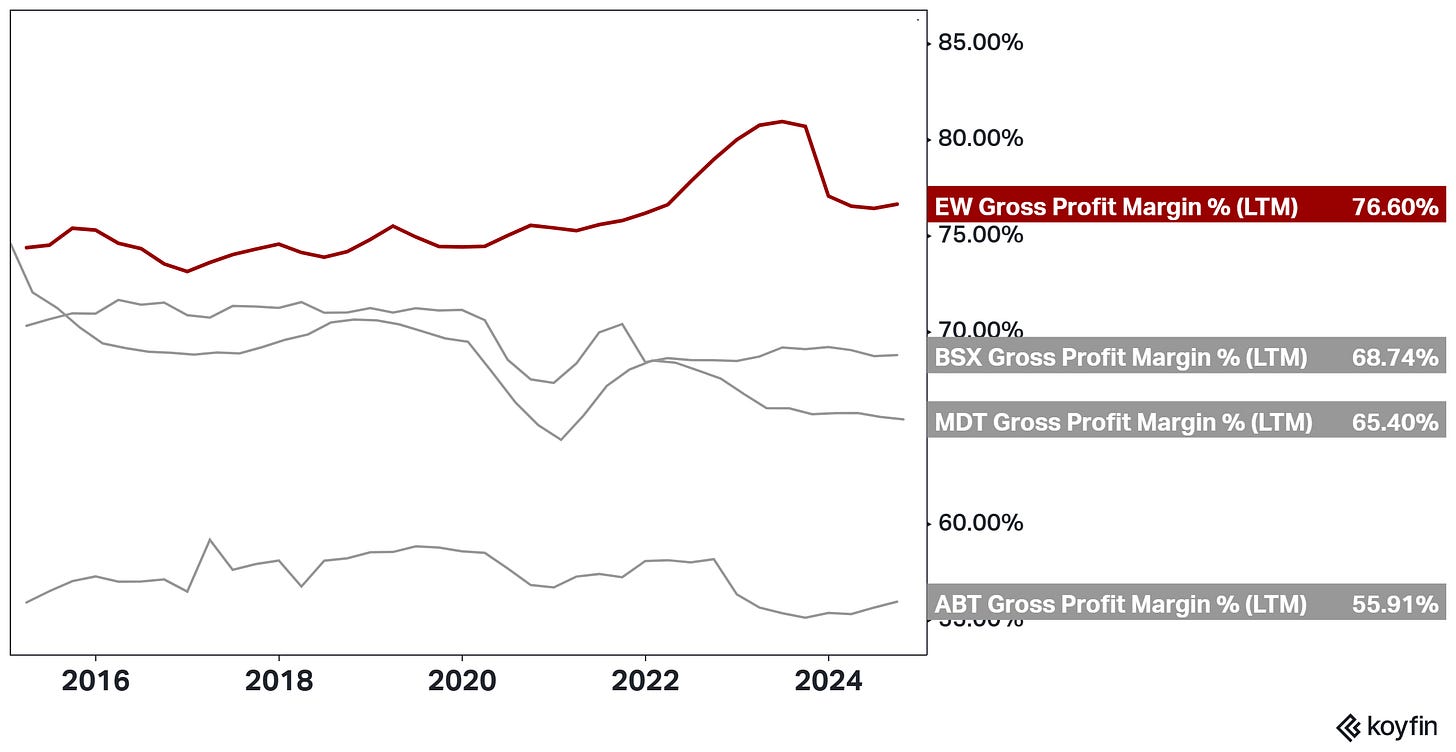

Best-in-class Profit Margin

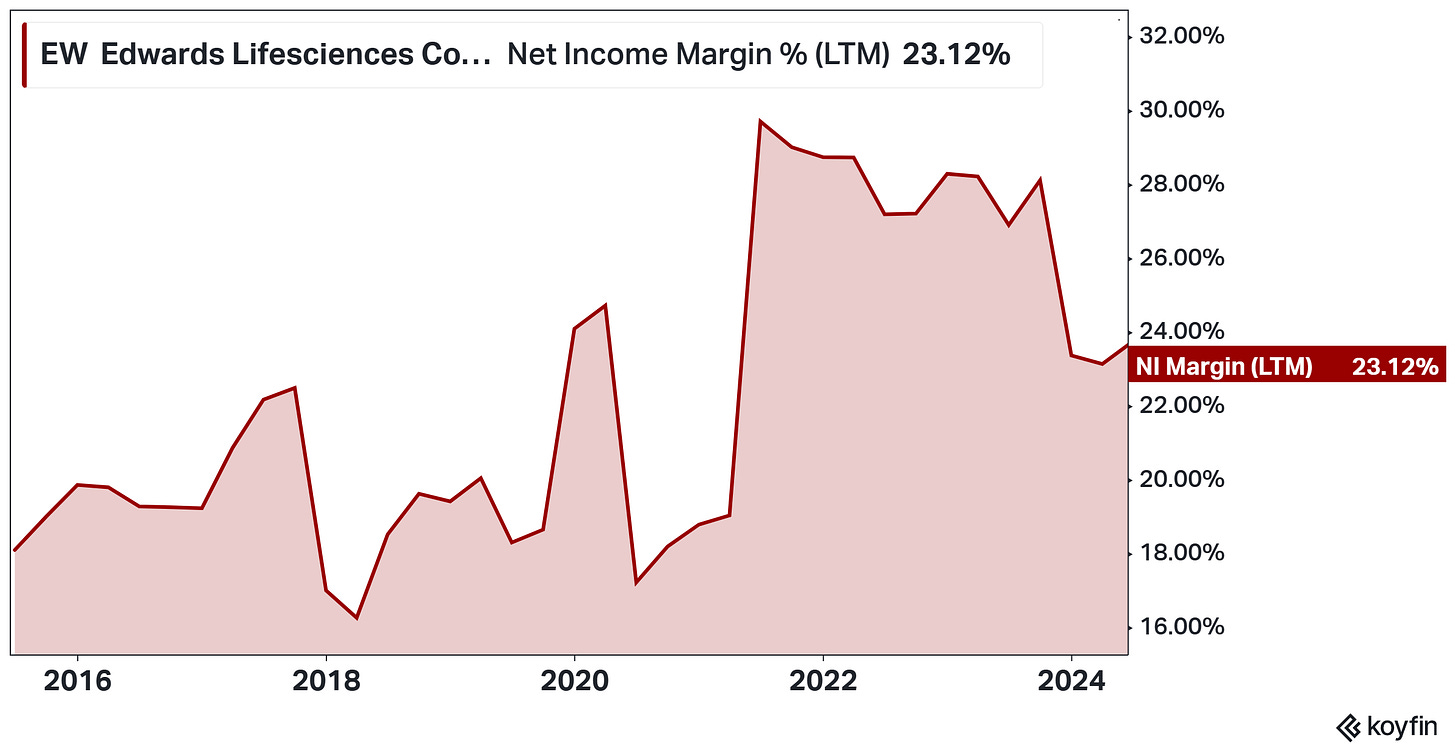

Thanks to its leadership and the quality of its devices, Edwards can sell its products at higher prices, securing the best margins in the industry.

Although it has fluctuated recently, it has never fallen below 20% for a long time.

In recent quarters, Edwards' profit margin declined due to recent acquisitions and the launch of new products in the TMTT business; I expect it to recover to 28% by 2030. This expansion will be driven by an annual operating leverage of 50-100 basis points.

2024: a transition year

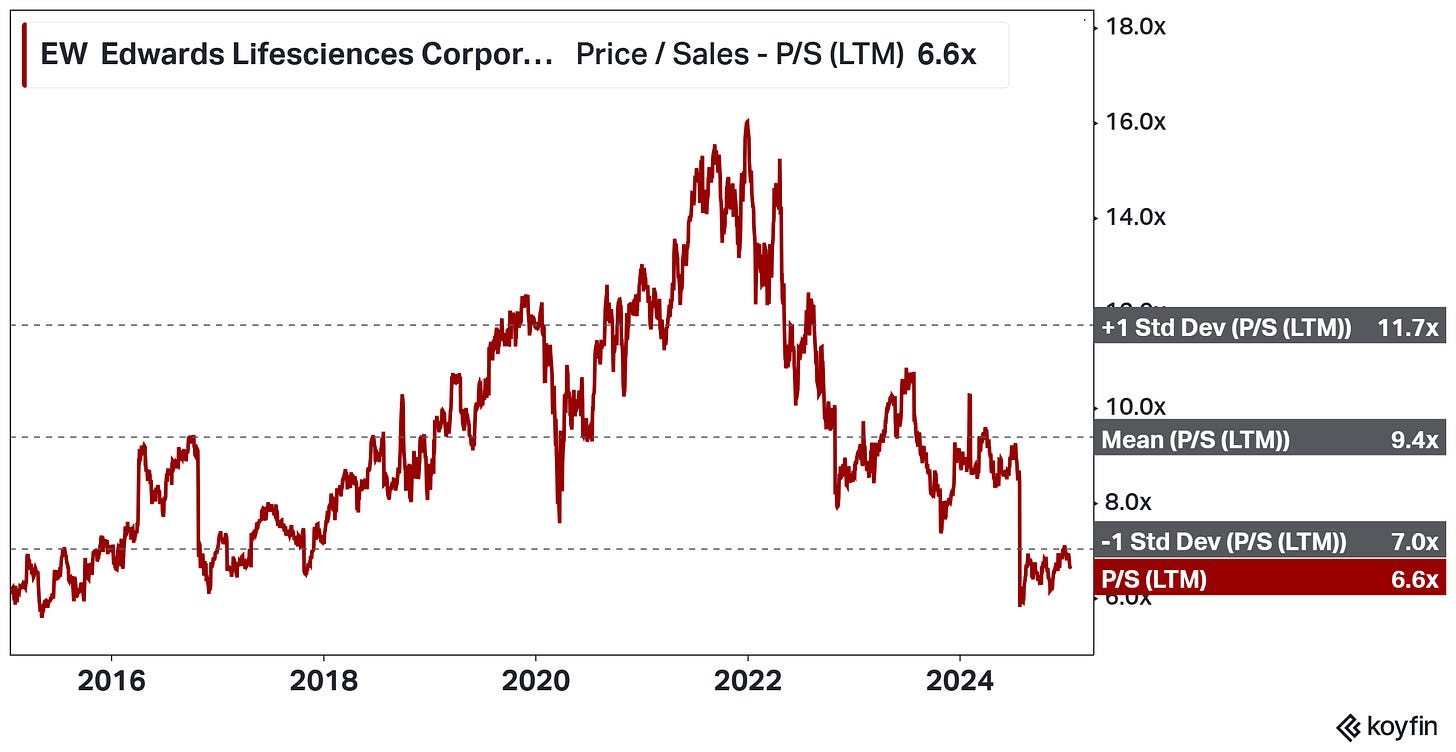

During the last three years, the price-to-sales multiple declined from 16x to 7x, reflecting lower market confidence in the company's future growth.

Here is a quick review of events that took place in 2024:

Edwards transitioned by selling its critical care division to BD for $4.2 billion. This reduces the company’s Revenue in the short term but allows Edwards to be 100% focused on structural heart going forward.

Using part of the cash received, Edwards completed four small acquisitions to expand its valve offerings.

The growth of the TAVR market has slowed more than expected due to a constraint in the medical centers.

The market perceives the weakness as structural.

In reality, Edwards is preparing to outperform in its next growth phase.

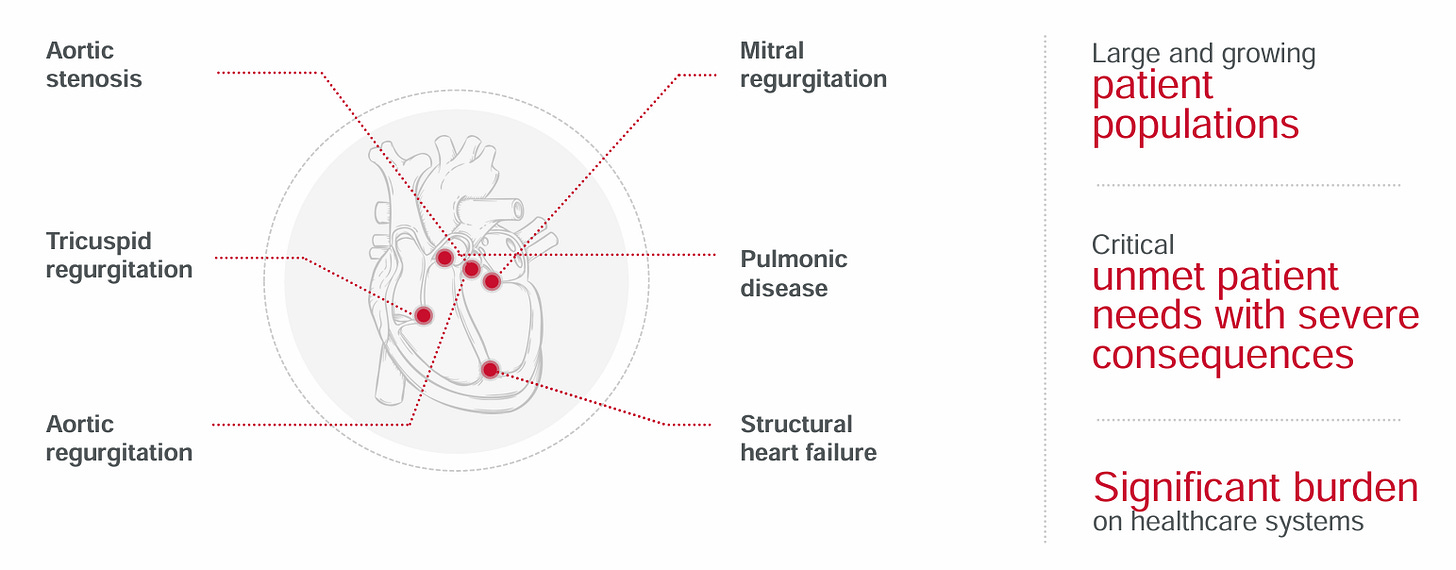

Structural Heart is a major opportunity

Edwards is the market leader in surgical (SAVR) and transcatheter (TAVR) aortic valve replacement for aortic stenosis, but they are expanding on three new fronts:

TMTT: Transcatheter Mitral and Tricuspid Technologies, this segment could generate $2 billion in annual Revenue by 2030.

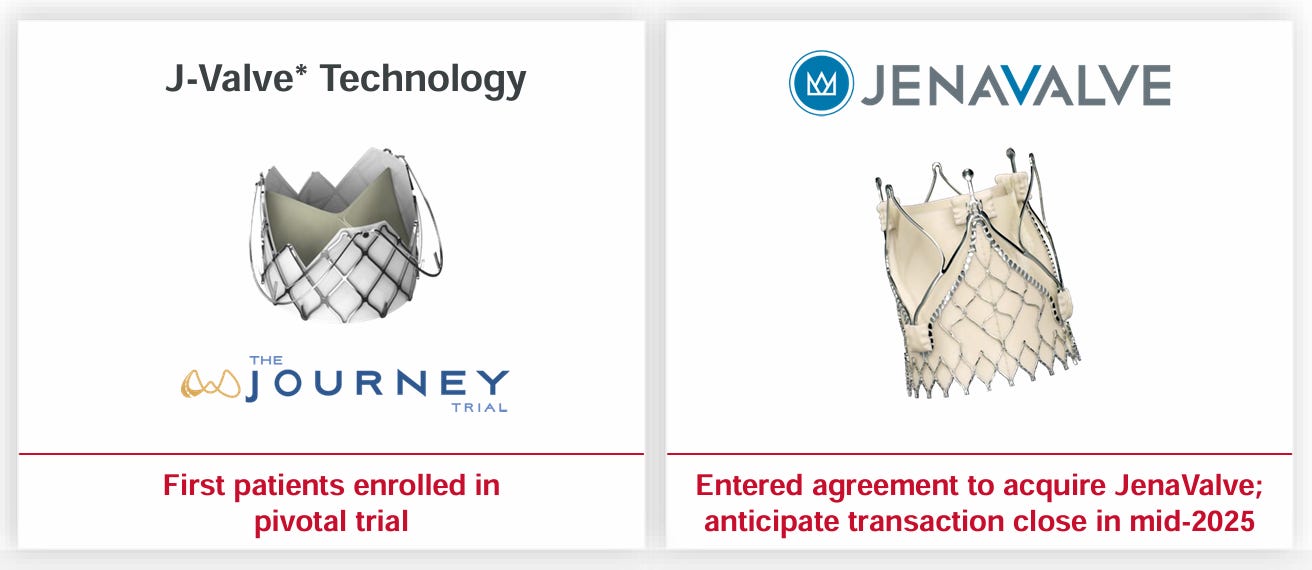

AR: Aortic regurgitation, thanks to the acquisitions of JenaValve and J-Valve.

HF: Heart Failure, thanks to the acquisition of Endotronix.

Let’s explore why Edwards’ growth story is not in its last chapters and why the company warrants a premium compared to its sector.

Key market growth is not over yet

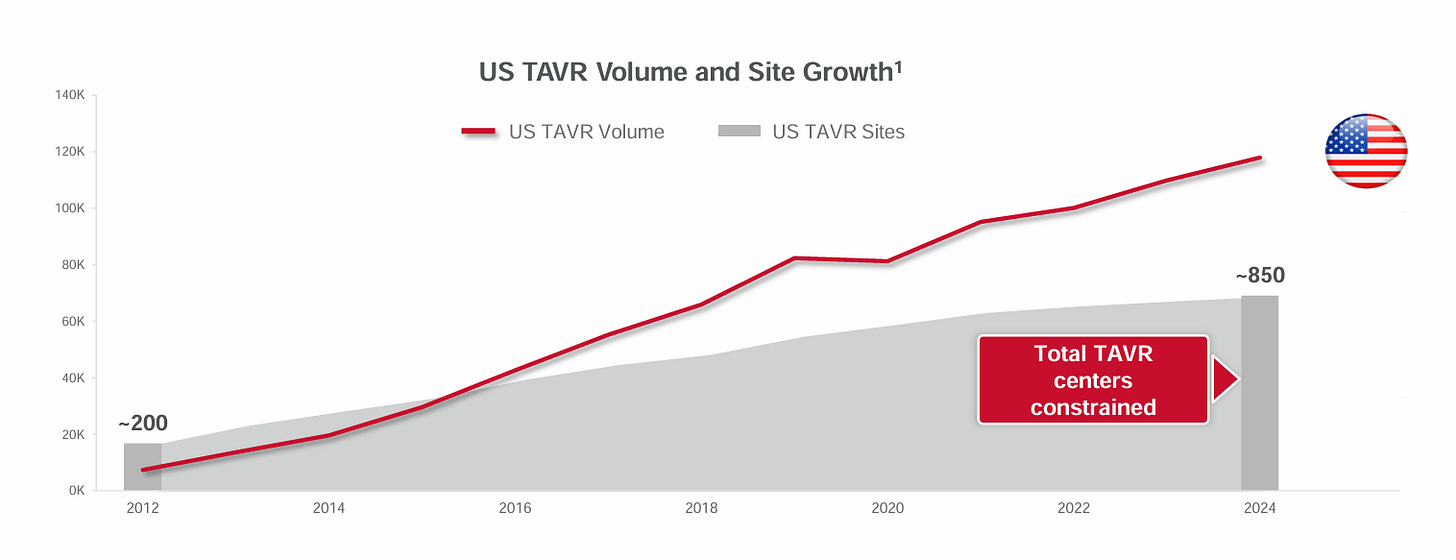

In the last decade, the number of TAVR procedures in the US has grown from 10,000 per year to 130,000 per year today.

However, the number of centers has not kept up with this growth rate, and by 2024, they will have reached a point of constraint, slowing down the expansion of the TAVR market.

In the TAVR $7 billion market, Edwards is the largest player and retains:

50-55% of market share worldwide.

>70% share in the United States market.

This role is attributed to the company's innovation, competitive edge, and ability to produce devices that achieve optimal patient outcomes.

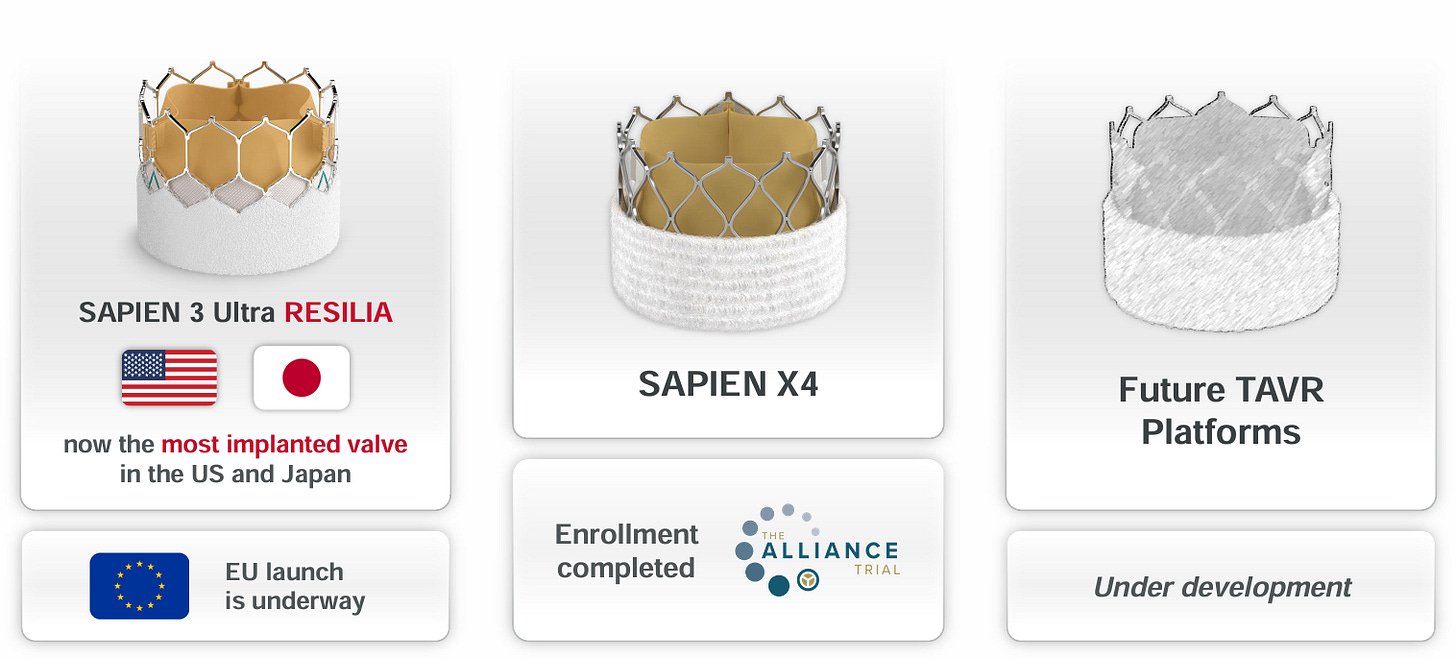

Thanks to its focus, Edwards should continue to dominate this market due to the new generations of Sapien valves, while Medtronic, Abbott, and Boston Scientific will share the remaining market share.

Edwards TAVR franchise should benefit from the following catalysts:

The arrival of the new Sapien X4 generation.

The approval of Early TAVR in mid-2025 will expand the procedure to include asymptomatic patients.

The increased capacity of centers for TAVR procedures, driven by the growing number of patients.

AR is an underrated catalyst

74% of patients with aortic regurgitation (AR) do not receive treatment, according to the company.

This means that Edwards has the opportunity to develop a transcatheter aortic valve replacement (TAVR) market for AR, similar to the development dynamics that drove the success of the Sapien devices.

Edwards aims to establish this new market by acquiring J-Valve and JenaValve, whose Trilogy technology could receive approval by the end of 2025.

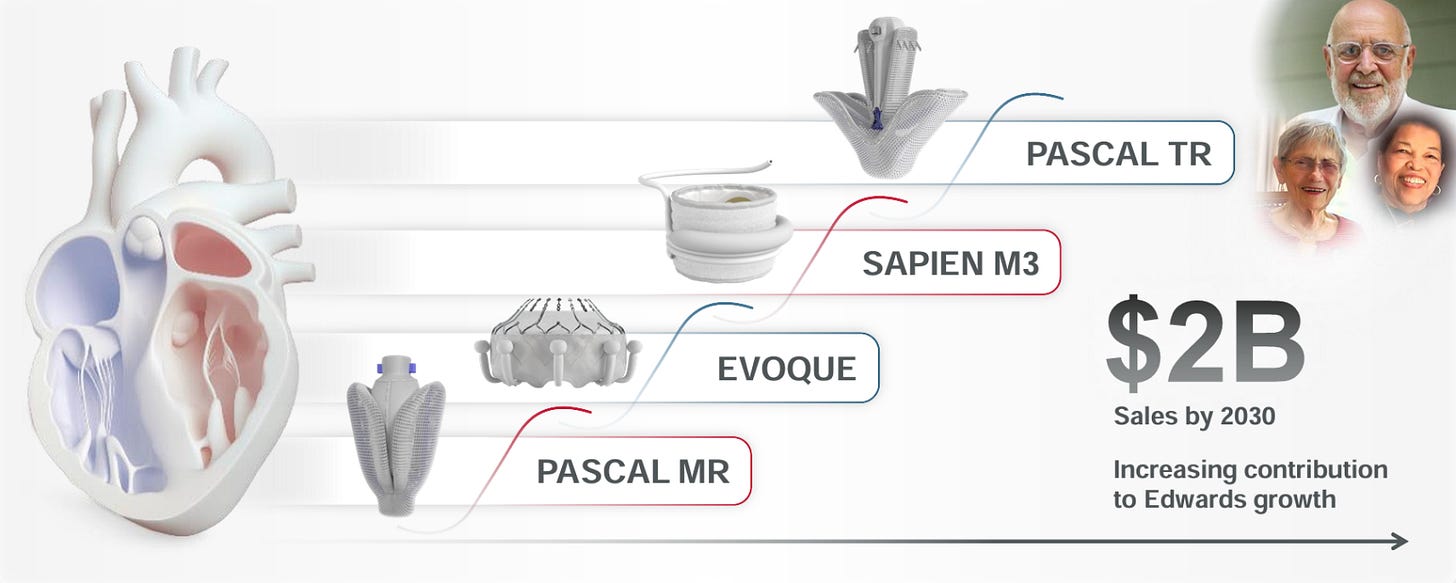

TMTT: the key to the new growth era

Despite the slowdown in the TAVR market, Edwards has found its new growth engine: mitral and tricuspid valve repair and replacement procedures.

Combining these two treatments allows us to care for more surgically inoperable patients, significantly improving the outcomes of those who previously relied solely on medical therapy.

The devices driving this growth include:

Pascal MR, approved in 2022, with the next-generation release expected in 2026.

Sapien M3, the first mitral replacement system. Its approval is anticipated in Europe by 2025 and the US by 2026.

Evoque, the world's first replacement valve for tricuspid regurgitation, addresses significant market demand and demonstrates positive clinical outcomes.

Pascal TR, a follow-up release is expected in the second half 2025.

This business segment could be for Edwards what TAVR has been over the past decade.

The TMTT segment is expected to grow by 50-60% YoY, reaching $500 million by 2025.

The goal is to quadruple Revenue to $2 billion by 2030.

Edwards is ready to accelerate again

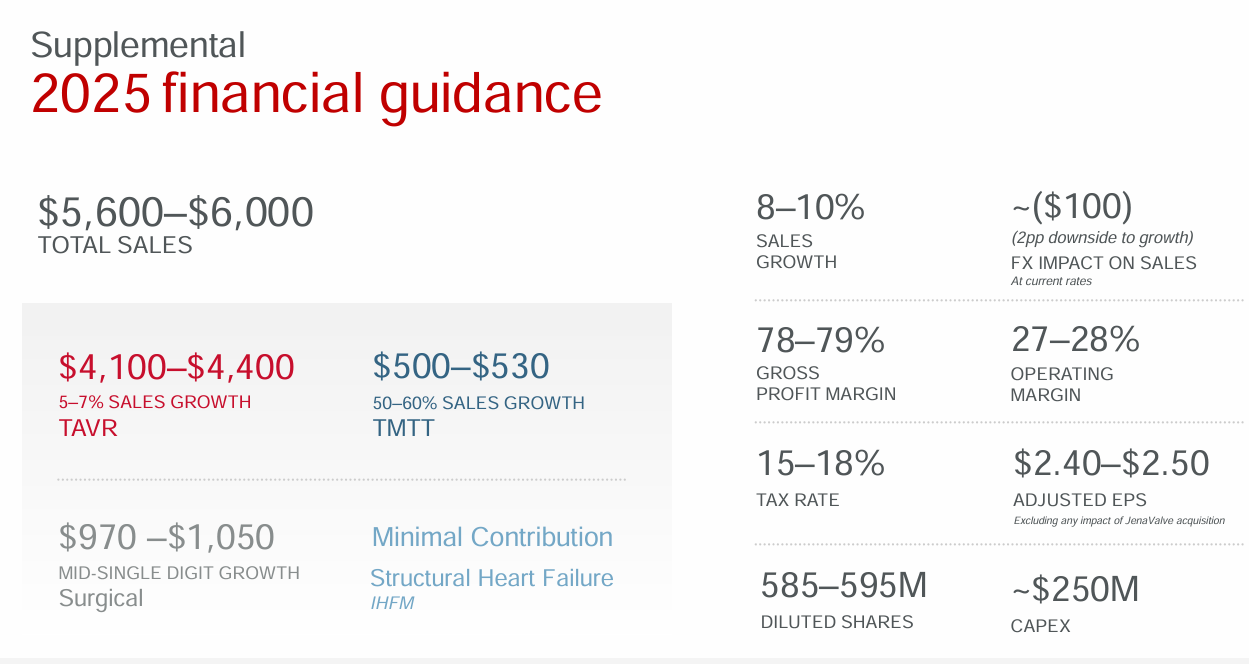

The company expects for 2025:

8-10% Revenue growth, primarily driven by TAVR and TMTT.

27-28% Operating Margin, temporarily lower due to increasing costs related to the new acquisitions.

$250 million Capex, below the last year’s average.

2025 is an excellent starting point for understanding how growth will evolve, ultimately shaping the company's valuation.

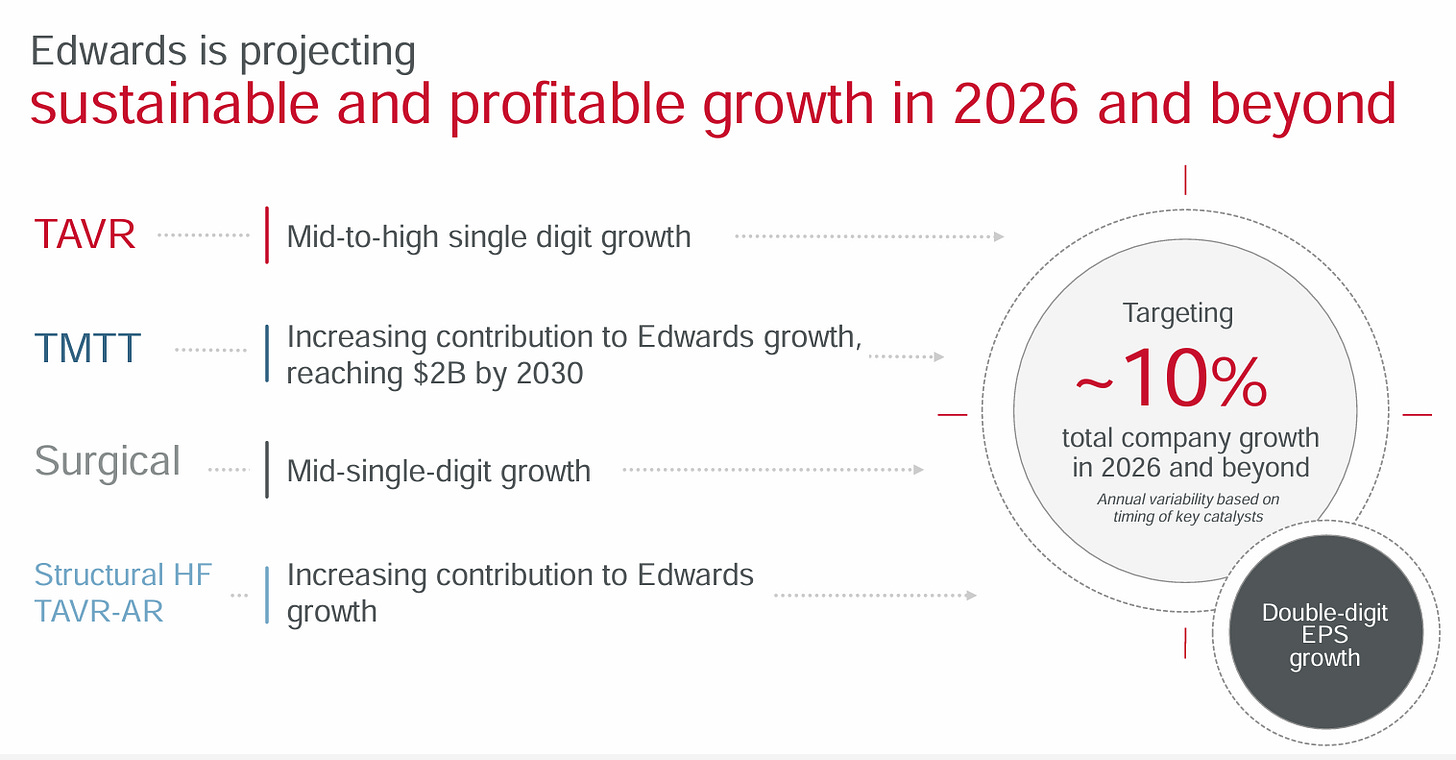

Double-digit growth is back

During the latest annual investor meeting, Edwards provided new long-term growth targets.

The company expects an average Revenue growth of 10% per year starting in 2026.

Considering the company’s strong track record of delivery in the past, except for the recent period, and the expected increase in demand for structural heart therapies, I have chosen to use the following assumptions:

TAVR: 7.5% CAGR, reaching $6.2B by 2030.

TMTT: 31% CAGR, reaching $2B by 2030, in line with the target.

SURGICAL: 5% CAGR, reaching $1.3B by 2030.

HF and AR: $500M by 2030.

These figures would position Edwards to generate approximately $10 billion in Revenue by 2030.

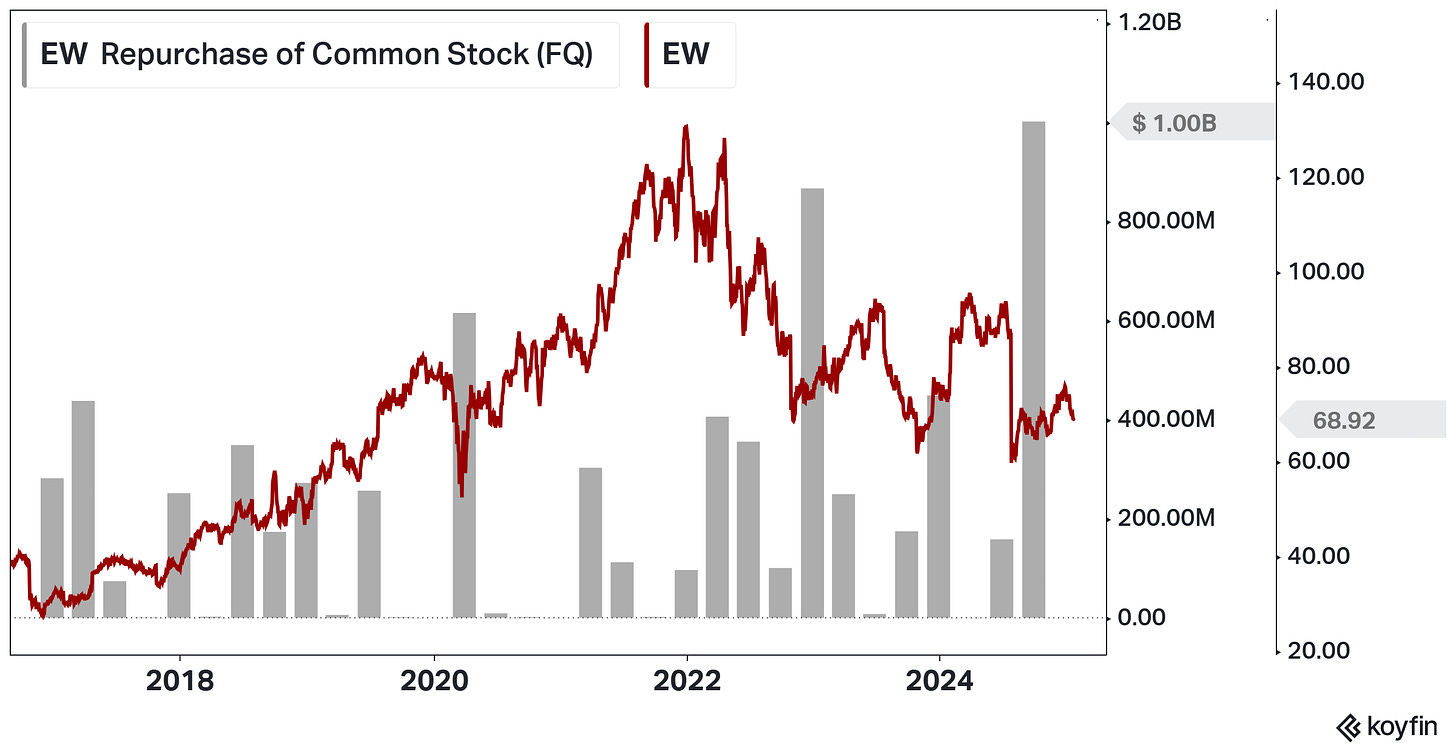

Edwards is a great capital allocator

In recent years, Edwards has demonstrated an efficient approach to capital allocation, conducting buybacks only during periods of stock weakness:

For instance, as the stock price dropped to $60 last quarter, Edwards promptly spent $1 billion in Buybacks.

The company will likely continue utilizing a portion of its generated FCF for share buybacks, estimated at 1-2% annually.

Supported by the current undervaluation, share repurchases could reduce the Shares Outstanding to 550 million by 2030.

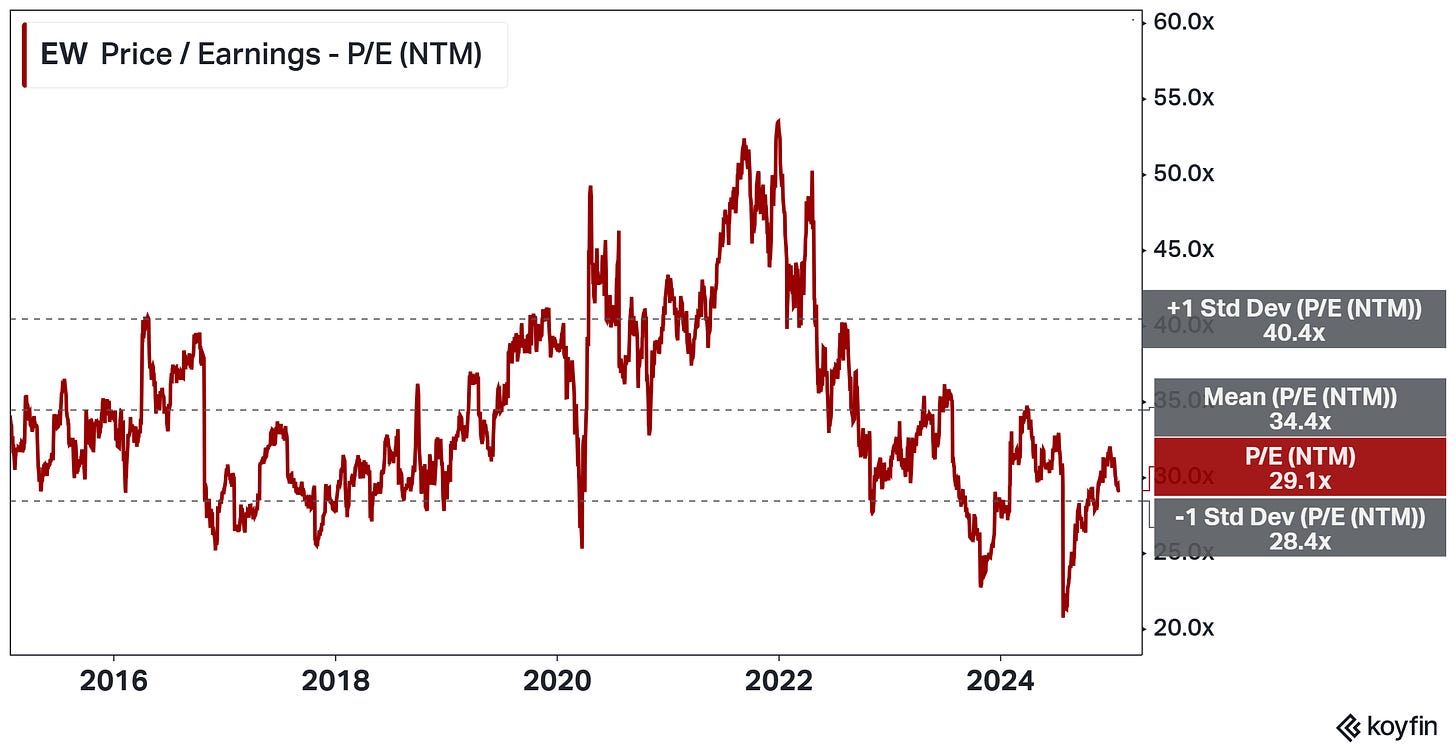

Stock is trading at historically low multiples

Currently, Edwards trades at 29x NTM P/E, which is in the low area of its historical range of 30x-40x.

However, considering that the sale of the Critical Care business and new acquisitions will negatively impact the 2025 EPS, we obtain a ~25x adjusted P/E multiple, close to its historical absolute lows.

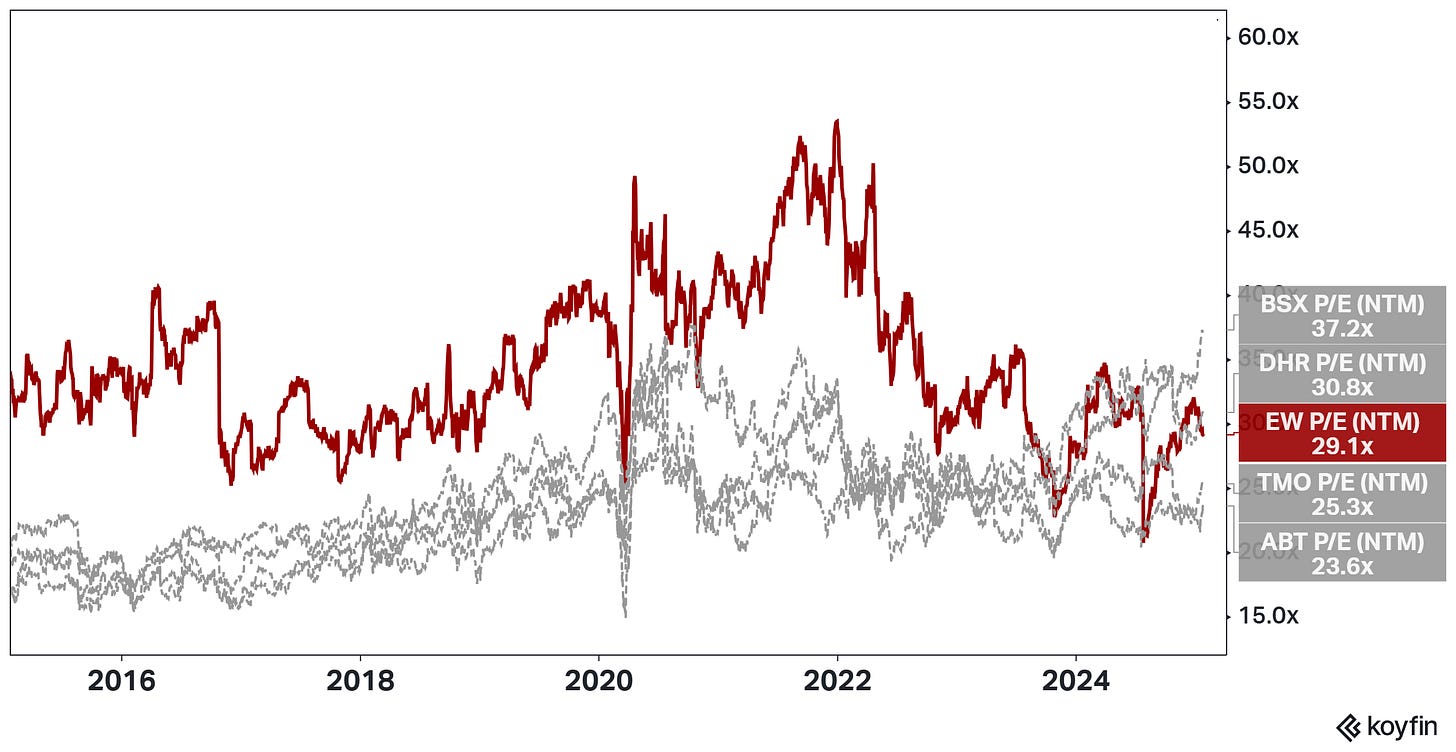

By comparing the multiple with peers (Medical Devices and Diagnostics) such as Boston Scientific, Abbott, Danaher, and Thermo Fisher, it is evident that Edwards has lost the premium it historically enjoyed.

This is unjustified, given that the company continues to boast the best margins and the highest long-term growth potential in the sector.

For these reasons, I expect a P/E multiple of at least 30x in the medium/long term.

Although this may seem somewhat high, several factors justify it:

The quality of the business, thanks to Edwards’ focus on the structural heart.

The high profitability and gross margin are similar to that of a software company.

An excellent financial position, with $4 billion in net cash and near-zero debt.

An aging population drives stable long-term growth.

Edwards is Undervalued

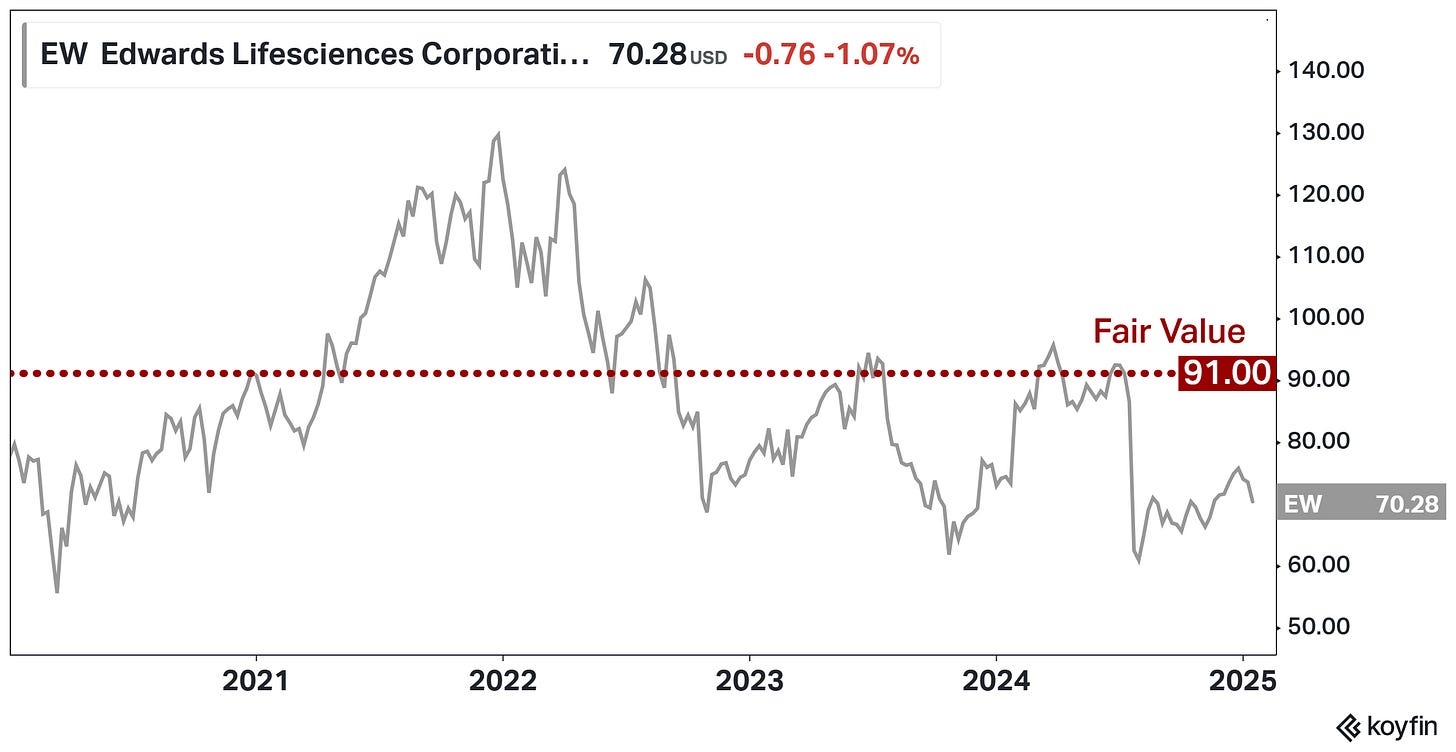

Considering everything we have discussed, we can calculate a valuation based on future EPS and multiples.

My assumptions for 2030 are based on:

$10B of Revenue, mainly driven by TMTT and TAVR.

28% Profit Margin, thanks to new product adoption and operating leverage.

30x P/E, supported by industry average, market leadership and long-term growth.

550 million shares outstanding following consistent buybacks.

I arrived at fair value by:

Multiplying the 28% Profit Margin by $10 billion in Revenue, we get $2.8 billion in net income for 2030.

Dividing this by the projected number of shares (550 million), we calculate an EPS of $5.10 for 2030.

Multiplying the EPS by a 30x P/E ratio gives us a fair value of $153 per share in 2030.

Discounting the $153 at a 9% rate over 6 years, we determine the present Fair Value of $91.

The $91 Fair Value is 30% higher than the current price of $70 and implies an expected annual return of 14% over the next six years.

The biggest risks I see for Edwards are a potential erosion of its leadership position in the TAVR market and difficulties in scaling new business segments like TMTT and AR.

However, considering the stock's current undervaluation and the low likelihood of these risks materializing, I believe there is a quite good margin of safety.

Conclusion

Edwards has been a compounder for many years, but recently, the market has strongly penalized the company due to specific strategic decisions and a slowdown in growth.

The market seems too focused on the short term, and the current price doesn’t reflect Edwards’growth potential and market leadership.

For this reason, I find any price below $70 highly attractive, and I added the EW 0.00%↑ stock to my portfolio.

If you enjoyed the article, please support me with a ❤️ and share it.

Follow me!

Linkedin: Natan Cornaggia

Disclaimer: the information provided in this article is based on my research and is for informational purposes only. It should not be construed as financial advice. Please conduct your research before making any financial decisions. The author is not responsible for any financial losses or damages incurred as a result of following the information presented in this article.

Beating article, great job Natan!

Good boy