Some companies are transforming the world yet remain divisive.

Moderna, with its pioneering mRNA technology, is one such case.

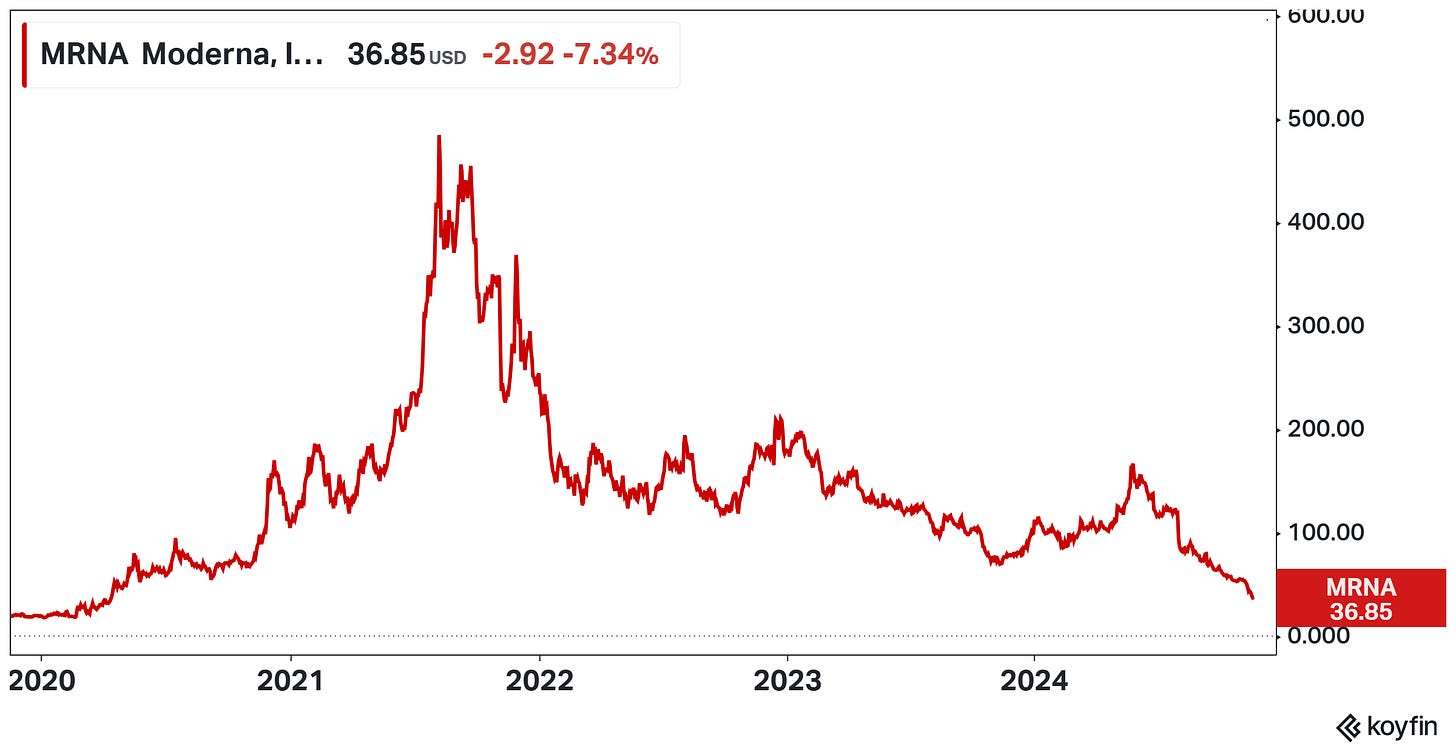

In this article, I aim to share key insights about Moderna, the biotech company best known for its COVID-19 vaccine. Despite a 92% decline in stock value over the past three years, there is potential for a turnaround.

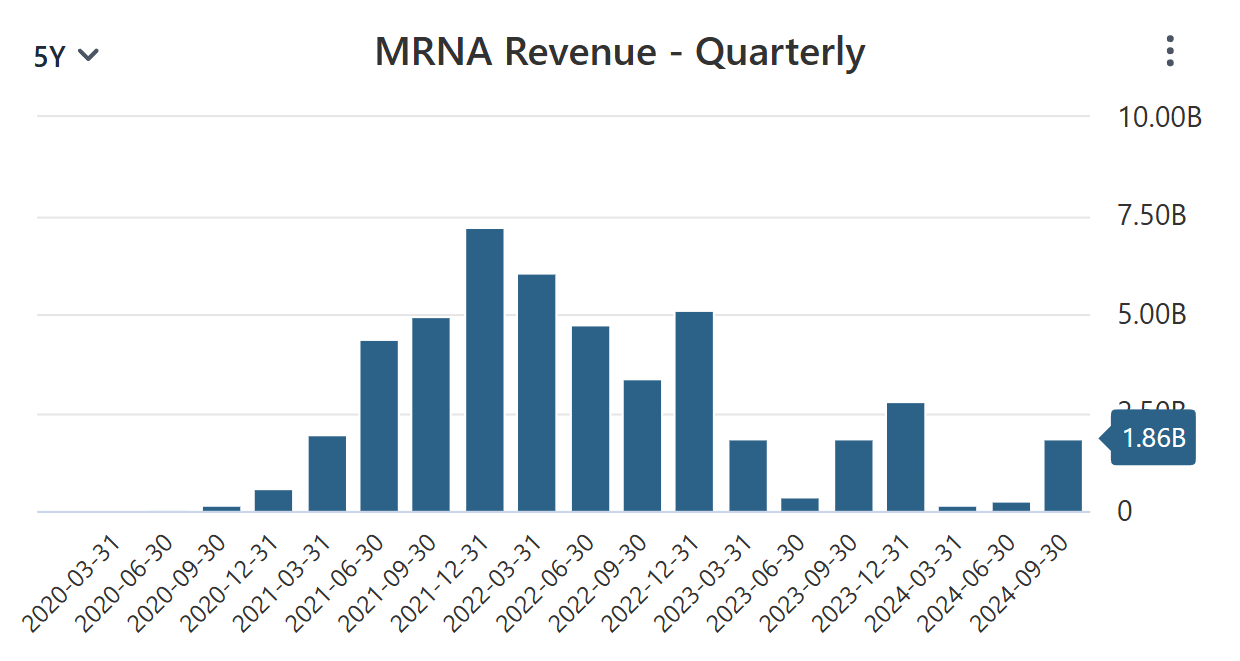

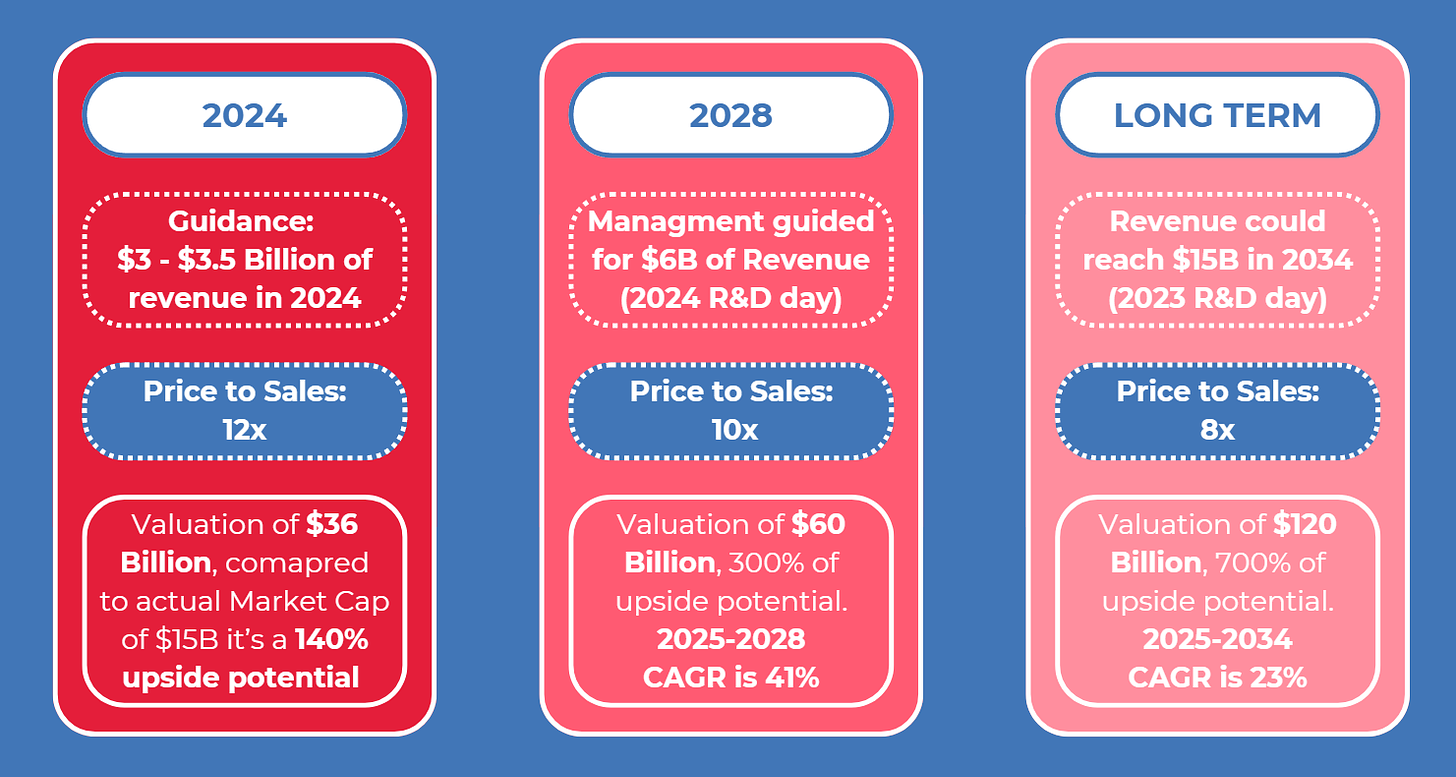

While 2024 revenues fell by 50% to $3.0–$3.5 billion due to waning vaccination demand, future drug launches are crucial to my thesis and will be key to revitalizing growth.

This is my first article. If you want to stay updated with future publications, please subscribe and support me with a ❤️!

The stock crash

Moderna's revenue fell by 50% in 2024 to between $3.0 and $3.5 billion, a decline from $6.7 billion in 2023 due to a faster-than-expected drop in COVID-19 vaccination rates.

The key events:

COVID vaccines are not an appealing narrative anymore but the total addressable market is expected to stabilize at $6 - $8 billion.

Management cut the long-term guidance during the 2024 R&D day. Moderna now expects to reach profitability by 2028, up from the prior estimate of 2026, assuming $6 billion in revenue in 2028.

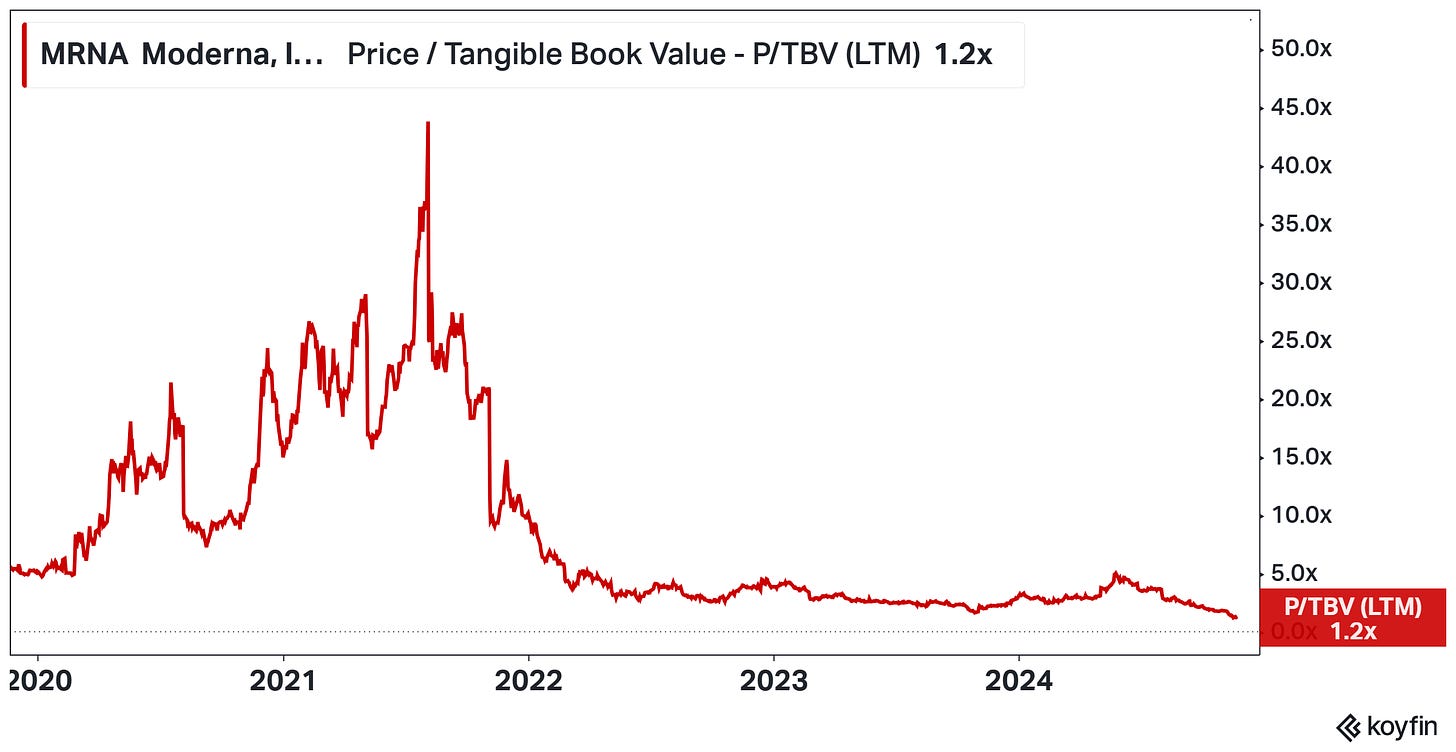

The decline in stock price is partly justified but the -67% YTD seems excessive. The stock has been in oversold territory for the last few weeks.

But it’s not over.

Not a common pharma: mRNA outperforms

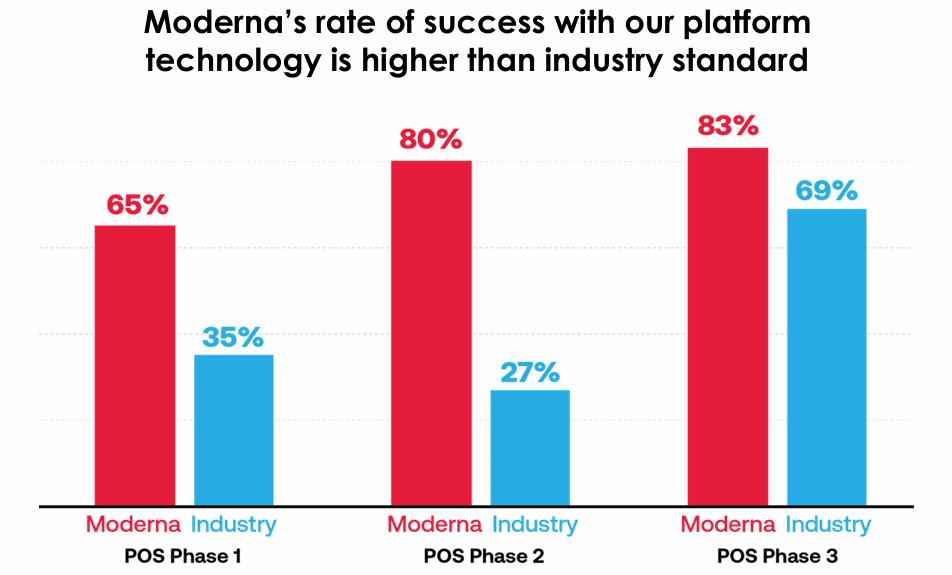

Moderna technology offers superior results vs standard discovery procedures.

Moderna is not a common pharma company.

For 15 years, it has developed an innovative mRNA technology platform that can be exploited in different therapeutic areas.

A big advantage of this technology is the higher-than-average successful rates of the clinical trials, in particular, Moderna has very high rates in all 1, 2, and 3 phases.

When you combine all three probabilities, Moderna has a total successful rate 6X higher than average, which leads to a high-cost saving in the R&D stages.

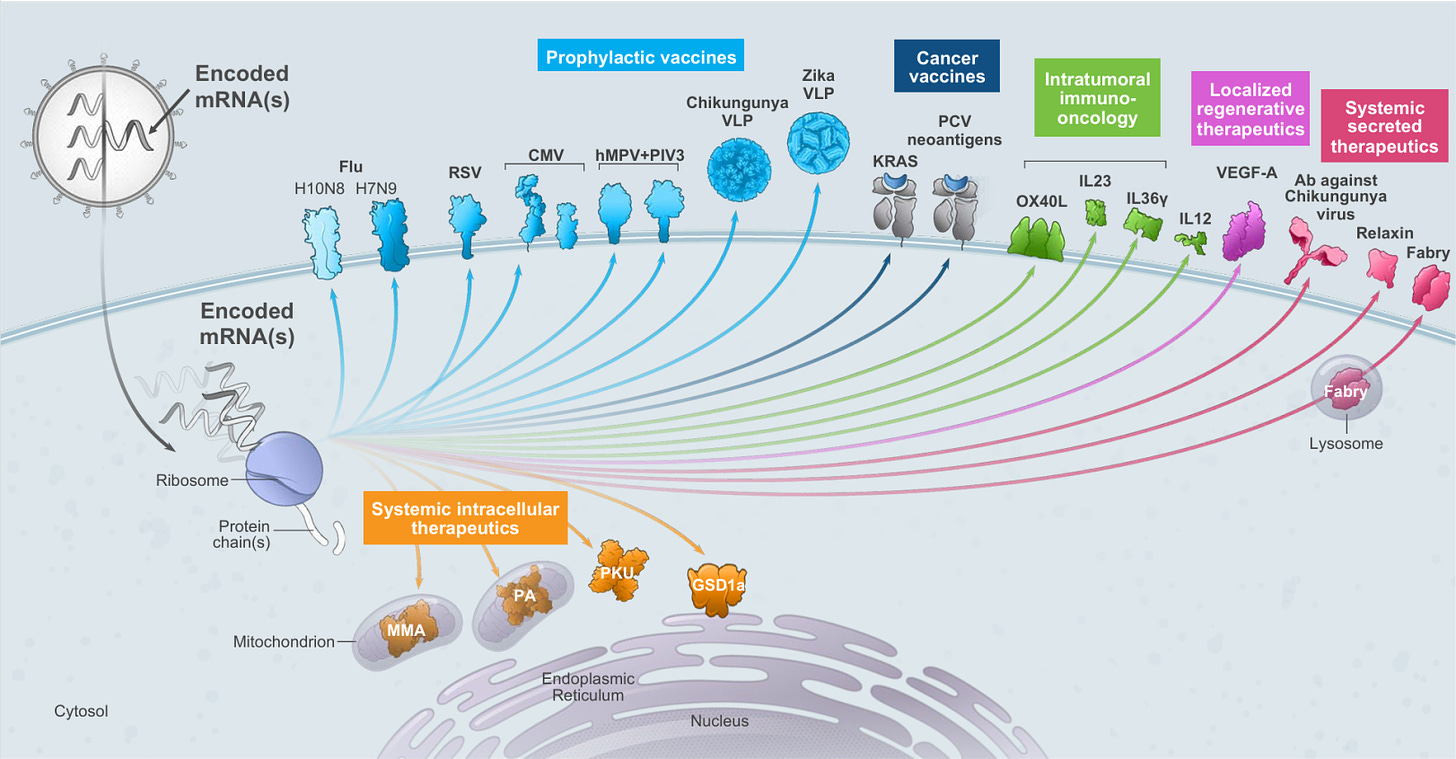

mRNA technology involves using synthetic messenger RNA to instruct cells to produce specific proteins, triggering an immune response or replacing deficient proteins to treat or prevent diseases.

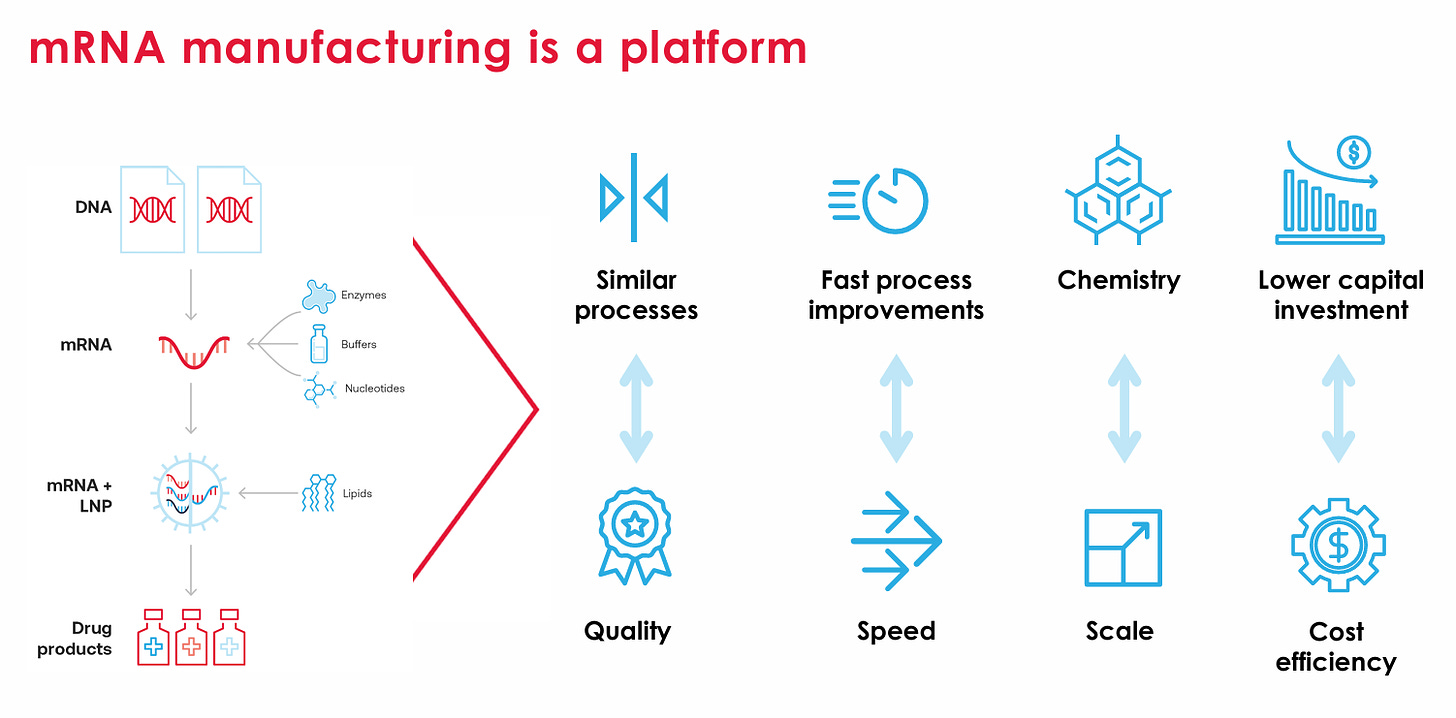

mRNA is a tech platform

Instead of seeing Moderna as a traditional pharmaceutical company, we should view it as a platform that enables:

Focus exclusively on mRNA vaccines with superior results.

Accelerate the development of new drug research processes.

Easily scale production and adapt it to market demand.

Achieve high profit margins as revenue grows.

This makes Moderna one of the few pharma companies vertically integrated, which could become the source of the company’s moat.

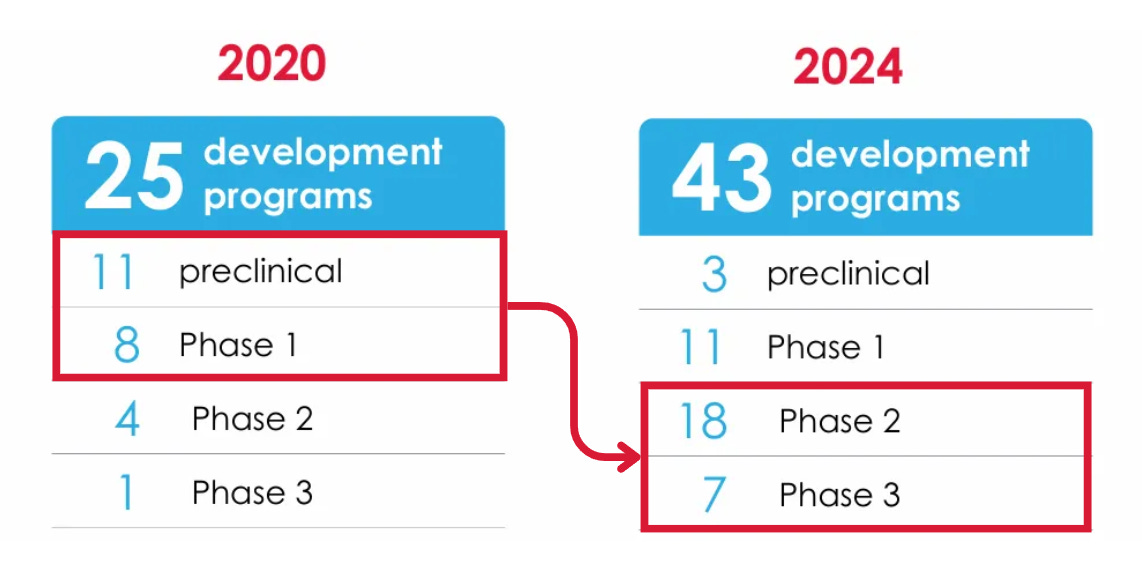

Moderna’s stunning pipeline growth

Moderna's vision has been progressively realized through its extensive development pipeline, which now includes over 40 drug candidates spanning various therapeutic areas: vaccines for respiratory and latent viruses, oncology, and rare diseases.

Leveraging its innovative mRNA platform, the company has successfully transitioned from the initial success of its COVID-19 vaccine to a broader portfolio that aims to revolutionize personalized medicine and disease prevention.

As you can see in the picture the pipeline development has been impressive during the last 4 years:

2020: 4 Phase 2 and 1 Phase 3 trials.

2024: 18 Phase 2 and 7 Phase 3 programs.

Revenue from COVID-19 vaccines has played a crucial role. Without them, the company would not have been able to invest $4 billion annually in research and development, making this huge progress impossible.

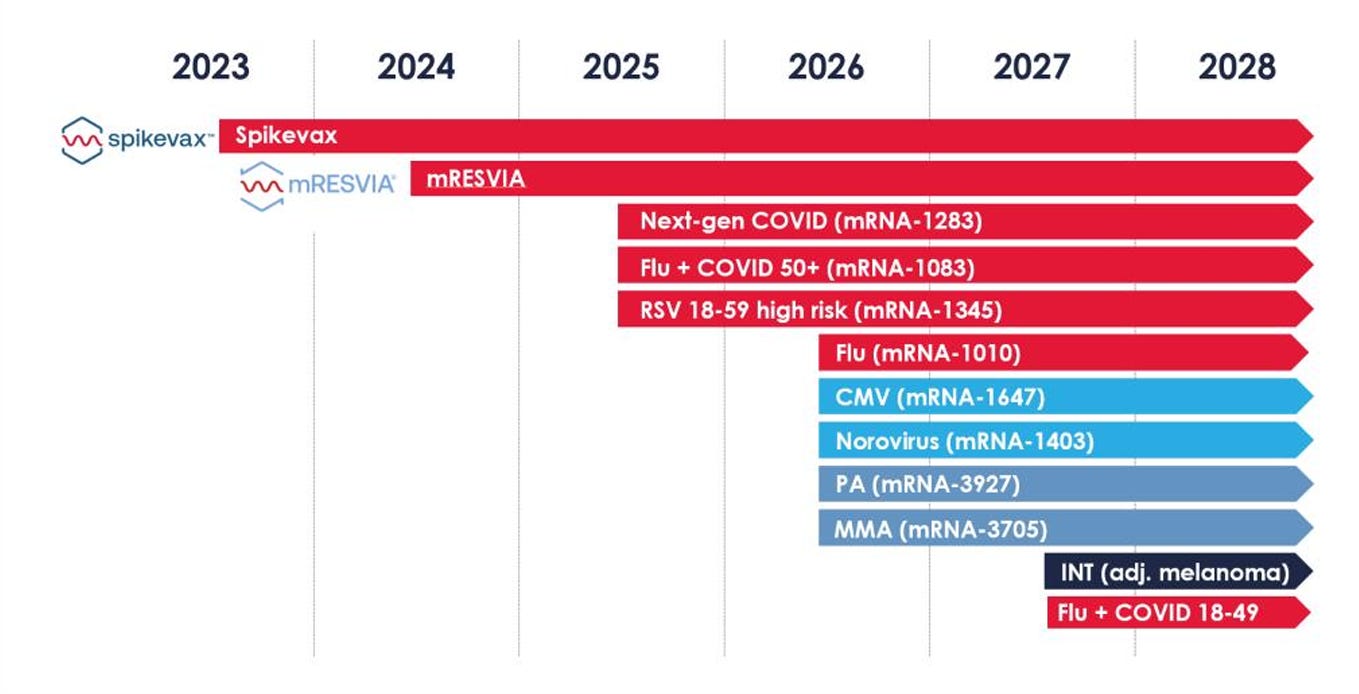

Approvals are coming

The company seems truly confident about the approvals and is working to launch 10 drugs in the next three years.

I expect that a short-term stock price catalyst could be positive Phase 3 data for the world’s first CMV vaccine which could happen by the end of the year,

Looking further, therapeutic cancer vaccines developed with Merck, if proven effective in Phase 3, could represent a significant narrative shift.

A sign of confidence: Insiders hold about 10% of the outstanding shares, and three of the four top executives (CEO included) still retain approximately the same number of shares they held before the COVID event. This is certainly a positive signal, as they could have sold their stakes during the 2021 price bubble.

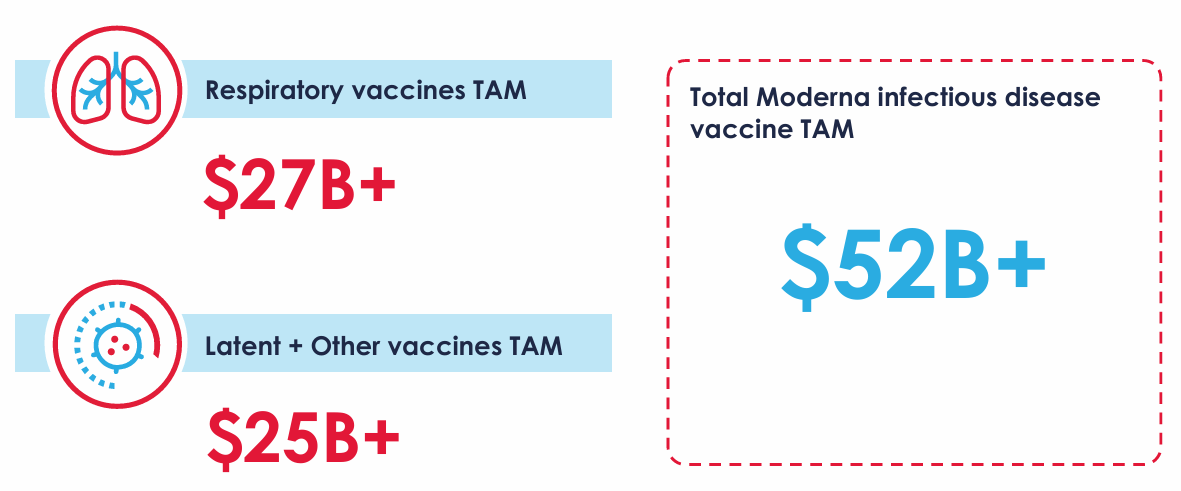

Infectious diseases have a massive TAM.

Evaluating a company like Moderna is complex:

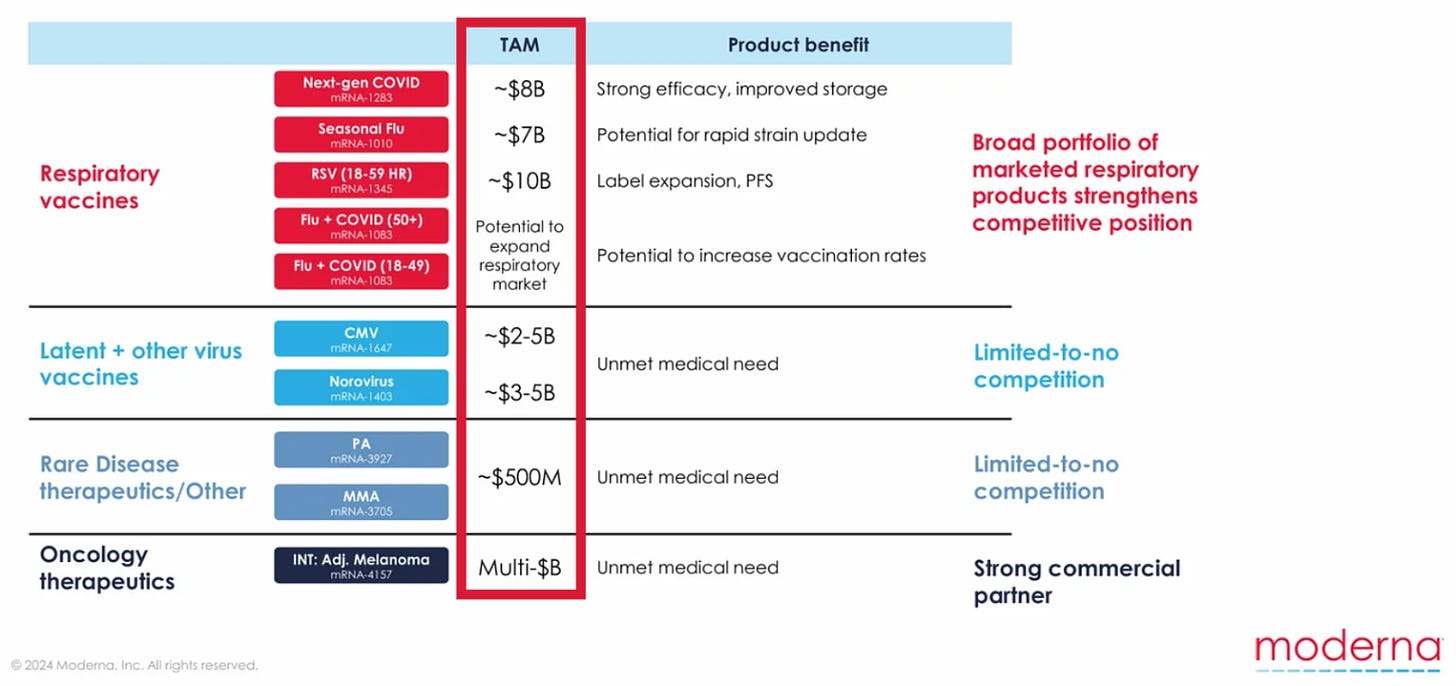

The drug pipeline is extensive, making it difficult to estimate each drug's probability of success and TAM.

It is difficult to assign a precise value to the tech platform the company has been developing over the past 10 years.

However, we can consider the guidance provided by management for this year and 2028. For the long term, we can also look at the TAM (Total Addressable Market) of the drugs they are developing, keeping in mind that they are not yet approved and some may be discarded.

Respiratory vaccines and those for latent viruses have a potential TAM of nearly $50 billion, not accounting for rare diseases and individualized therapeutic cancer vaccines developed in partnership with Merck, which have shown positive results in Phase 2 trials.

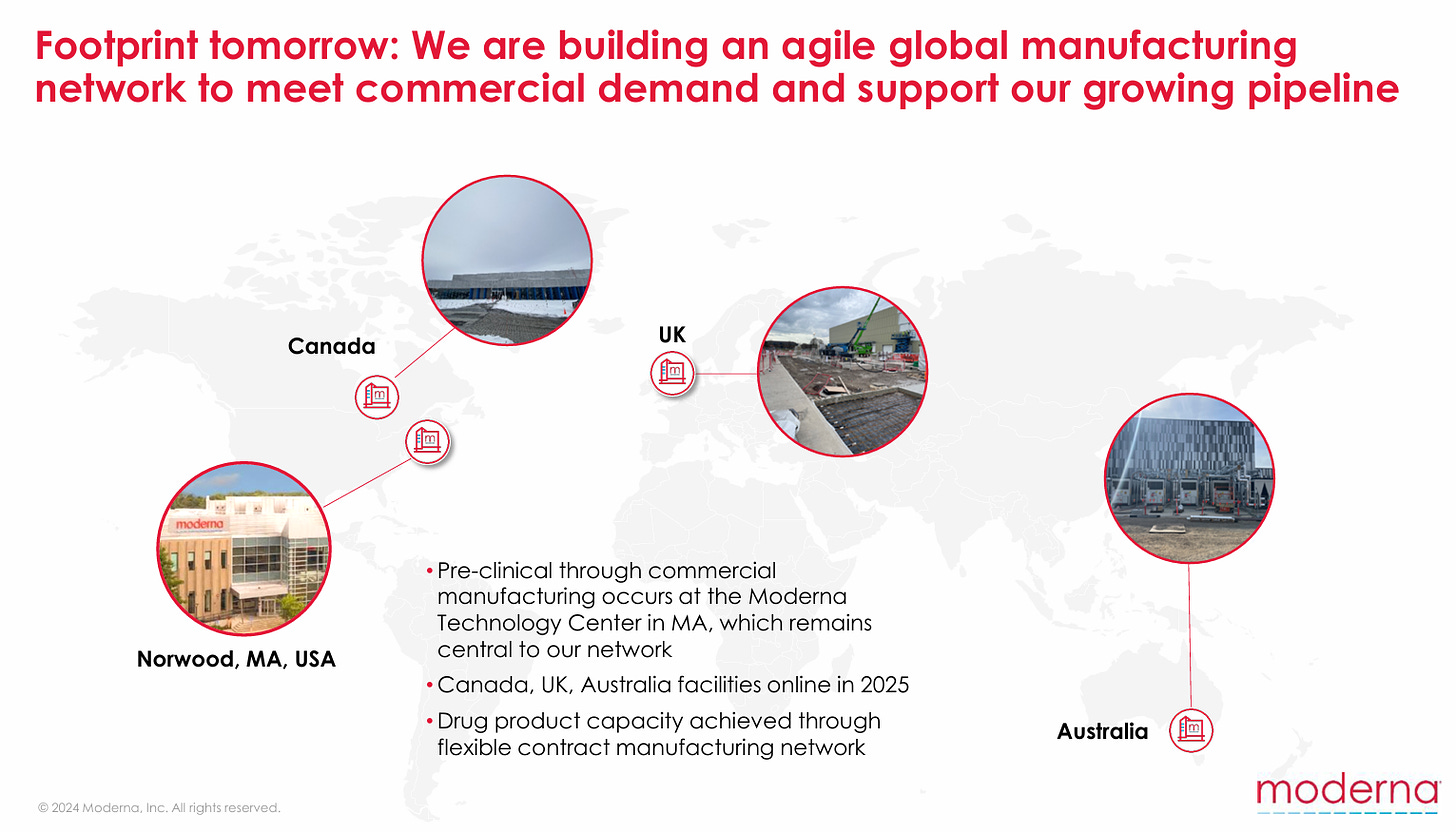

Furthermore, in 2024 alone, it spent $1 billion in capital expenditures to build manufacturing facilities, ensuring it is ready for the commercialization of future drugs worldwide.

Strong upside potential amid uncertainty

A proper valuation should value each drug in the pipeline, but the long-term guidance could give us a hint at its potential.

In 2023, management stated that the company could reach $20-30 billion in long-term revenue with its current pipeline. However, given the decline in COVID-19 vaccine sales and likely over-optimism, I believe $15 billion is a more reasonable target for 2034.

Given the uncertainty surrounding future free cash flows, Moderna could be valued using a price-to-sales multiple. Considering the company’s structure, Moderna's valuation should be based on its long-term pipeline potential rather than its current financials.

Moderna in 2034 could be worth $120 Billion based on:

$15B Revenue: assuming a moderate market share in respiratory vaccines ($7B), some approvals among latent viruses ($4B), and the launches of oncology vaccines and treatments for certain rare diseases ($4B).

8x price-to-sales multiple: considering the operational efficiency of the mRNA tech platform, I expect that in the long term, the company could achieve a 30% profit margin and therefore deserve a high price-to-sales multiple, in line with the historical multiples of the best biotech companies like Vertex and Regeneron.

This could correspond to a 23% 2025-2034 CAGR making the current price of $40 an appealing entry point for a patient shareholder.

Below you can see my estimates about the evolution of fair value:

At current prices, Moderna is trading near its book value of $31 per share, indicating that the market is pricing in negative returns on its pipeline investments.

Given everything discussed in the article, this scenario seems highly unlikely to me, making the risk/reward outlook particularly attractive.

Key risks ahead

Here are the three biggest risks:

Since the drugs are still in the pipeline, there is a constant risk of non-approval. Even after approval, commercialization may face unexpected challenges, including new competitors.

Due to ongoing investments, the company’s $9 billion cash reserve is expected to shrink over the next four years. If revenues are significantly delayed, it may need to issue debt or dilute equity.

RFK Jr.'s nomination to HHS adds uncertainty to the pharmaceutical sector, especially for mRNA vaccine makers like Moderna, due to his public statements.

I don’t think these are particular issues because:

Given the high approval rates, Moderna appears better positioned than the industry. Additionally, the company has demonstrated its ability to rapidly scale the COVID-19 vaccine commercialization.

Management appears to have undertaken cost-efficiency measures to ensure a sustainable burn rate. Moreover, many expenses reflect the company's choice to invest in its future and can be reduced at any time if needed.

As recently stated by Moderna's CFO, what matters most in the long term are the scientific data supporting a therapy, not political ideologies, which appear to be only a short-term obstacle.

Conclusion

The market at this valuation seems to be pricing in only the company's short-term difficulties, without considering its massive future potential.

For this reason, Moderna has become part of my portfolio.

Want to know more? Keep following me as I'm working on a new article to better analyze the potential of the most promising drugs in the pipeline.

If you enjoyed the article please support me with a ❤️ and share it.

Follow me!

Linkedin: Natan Cornaggia

Disclaimer: the information provided in this article is based on my research and is for informational purposes only. It should not be construed as financial advice. Please conduct your research before making any financial decisions. The author is not responsible for any financial losses or damages incurred as a result of following the information presented in this article.

What a first article, Natan! Already looking forward to further insights.

Cheers,

Arny

Great article! I also added $PDD, $TMDX, $MRNA in my portfolio.