Welcome to Natan's Notes! A quick weekly update on the stocks that I cover, the opportunities I’m exploring, and the thinking behind my portfolio allocation.

Here’s what’s on deck this week:

Regeneron stock declined 60% in one year: opportunity?

To stay updated on future posts, please subscribe and show your support with a ❤️!

Regeneron stock declined 60% in one year: opportunity?

In recent days, I decided to open a new position in the biopharma sector by investing in Regeneron, a highly successful company founded in 1988 and still led by its two co-founders Leonard Schleifer and George Yancopoulos.

Despite facing some recent challenges, I believe that the 60% drop in the stock price is an overreaction when considering the company’s solid track record, the expected cash flow for the coming years, and the increasing investments it is making.

Let me briefly explain the key drugs that are driving the company’s revenues:

Dupixent: the fourth best-selling drug worldwide, generating $14 billion in revenue, with profits split 50/50 with Sanofi. It is used to treat various conditions, including atopic dermatitis, asthma, and chronic obstructive pulmonary disease (COPD).

Eylea and Eylea HD: the market leader in the anti-VEGF category, capturing 41% market share and generating $9.5 billion in sales in 2024. Although Eylea’s sales are declining due to the arrival of biosimilars, the company aims to maintain a strong position with the introduction of Eylea HD, a high-dose formulation.

Libtayo: a PD-1 immunotherapy drug that surpassed $1 billion in revenue in 2024. The company is heavily invested in this therapy, exploring various combination studies across multiple cancer types.

Now let’s move to the reasons behind the company’s recent downturn and why I believe the market is overreacting. Interestingly, this is the company’s worst drawdown in the past 20 years, even though its profits remain close to all-time highs:

Eylea slowdown: This is not a surprise; every drug has its lifecycle, and patent expirations inevitably lead to declining sales. However, data show that revenues outside the US are proving resilient, thanks in part to Eylea HD. This franchise is still expected to generate healthy cash flows for the company in the years to come. It’s also worth noting that the FDA’s multiple Complete Response Letters (CRLs) have significantly delayed the launch of Eylea HD.

Itepekimab Phase 3 failure: In recent days, the stock fell 18% following disappointing Phase 3 results for treating COPD. The company is still evaluating its options here, so it will be interesting to see how they decide to proceed.

Biopharma sector sell-off: Over the past year, the biotech and pharma markets have been under pressure, largely due to the change in government in the US and the accompanying shifts at the FDA. While some elected officials are proposing anti-science measures and Trump has announced plans to cut Medicare drug costs, I believe the market is overestimating most of these risks.

The Reasons Behind My Investment Decision

Despite recent setbacks, there are many positive factors that convinced me to allocate around 5% of my portfolio to this company. Research and development expenses have nearly doubled in the past five years. While these are costs, for a pharmaceutical company to succeed, it must invest in innovation, and Regeneron has one of the best track records in this area.

Unlike many pharma companies that rely heavily on acquisitions, often paying significant premiums and generating lower long-term returns, Regeneron stands out for its organic growth model, which sets it apart in the industry. A similar trend can be seen in the number of patents filed and in the workforce, both of which have been growing at double-digit rates. By contrast, many competitors are experiencing declines in these areas.

It’s true that all of these investments are costs that can impact short-term earnings (as is currently happening), but I believe this is the best strategy for maintaining a leadership position over the long term.

I find the pipeline promising, with numerous opportunities that could tap into a potential market of $220 billion by 2030. I will certainly delve deeper into the individual pipeline candidates in future notes, but for now, I’d like to provide a general overview.

Another interesting aspect is that the Regeneron Genetics Center has built the world’s largest privately owned database of sequenced DNA. This enables the company to identify more promising targets, increasing the probability of success and making R&D spending more efficient compared to its peers. This strategic advantage, coupled with the company’s innovation-driven culture, sets Regeneron apart from its competitors.

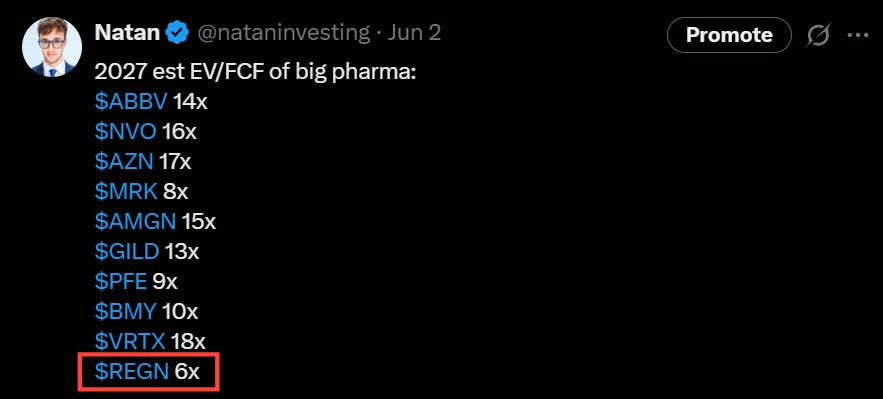

Regarding valuation, there is little to debate: looking at the company’s EV/FCF multiple for the coming years, Regeneron ranks among the lowest in the sector. This is quite striking given its historical results and the unique advantages I just highlighted. An EV/FCF of 6.5 for 2027 would suggest a company in terminal decline, something that couldn’t be further from the truth for Regeneron in my view.

In one of my upcoming notes, I will also explain why, in my opinion, even the expected cash flows from Dupixent alone would justify the current valuation, without factoring in Eylea, Libtayo, the entire pipeline, the genetics database, and the company’s impressive track record.

Equally important to my investment decision is the track record of the company’s two leaders. Whenever I hear them speak, it feels as if they talk about the company as if it were their own child, quite different from the attitude of most managers in the biopharmaceutical industry. The “skin in the game” factor is always a major plus in my book.

I’d like to conclude with some thoughts shared by the CEO earlier this year during the JP Morgan Healthcare Conference. I highly recommend taking the time to listen to the entire call.

“There's one constant. And the constant is investors always want to know what is that one thing that your company has that should make us want to invest. And in the early days of Regeneron, I answered that question in sort of an obtuse way. I said, well, it's our highly differentiated science. It's our technology that George and his team are developing. Because if you want to develop breakthrough drugs, you need to spend the time and effort to develop breakthrough technologies and understand the science”.

“But here we are, again, in 2025, lots of technological breakthroughs, more than 10 approved drugs, yet same question, what is that one thing, what is that one thing that why should we invest, what is it that people are missing, so on and so forth. And we have an answer. I am going to tell you, hang on. The answer is it's the pipeline. That's what people are missing“.

To dive deeper, I strongly recommend the following readings/videos:

“A Conversation with Regeneron Pharmaceuticals Chief Executive Officer, Leonard S. Schleifer”

“Regeneron: The Path from Basic Research to Commercial Product”

If you enjoyed the reading, please support me with a ❤️ and share it.

Follow me!

Linkedin: Natan Cornaggia

Disclaimer: The information provided in this article is based on my research and is for informational purposes only. It should not be construed as financial advice. Please conduct your research before making any financial decisions. The author is not responsible for any financial losses or damages incurred as a result of following the information presented in this article.

Great overview 👍

Nice quick overview, thanks! I'll keep digging.