Welcome to Natan's Notes! A quick weekly update on the stocks that I cover, the opportunities I’m exploring, and the thinking behind my portfolio allocation.

Here’s what’s on deck this week:

The recent decline of China’s E-commerce stocks

How I'm Managing My Exposure to the Sector

To stay updated on future posts, please subscribe and show your support with a ❤️!

The recent decline of China’s E-commerce stocks

After a strong start to the year for Chinese equities, especially Alibaba, which was up 75% YTD in just three months, the past few weeks have seen sharp pullbacks of 20–30% across the entire e-commerce sector.

With most global markets hitting new all-time highs, I believe this sector now stands out as one of the most compelling investment opportunities.

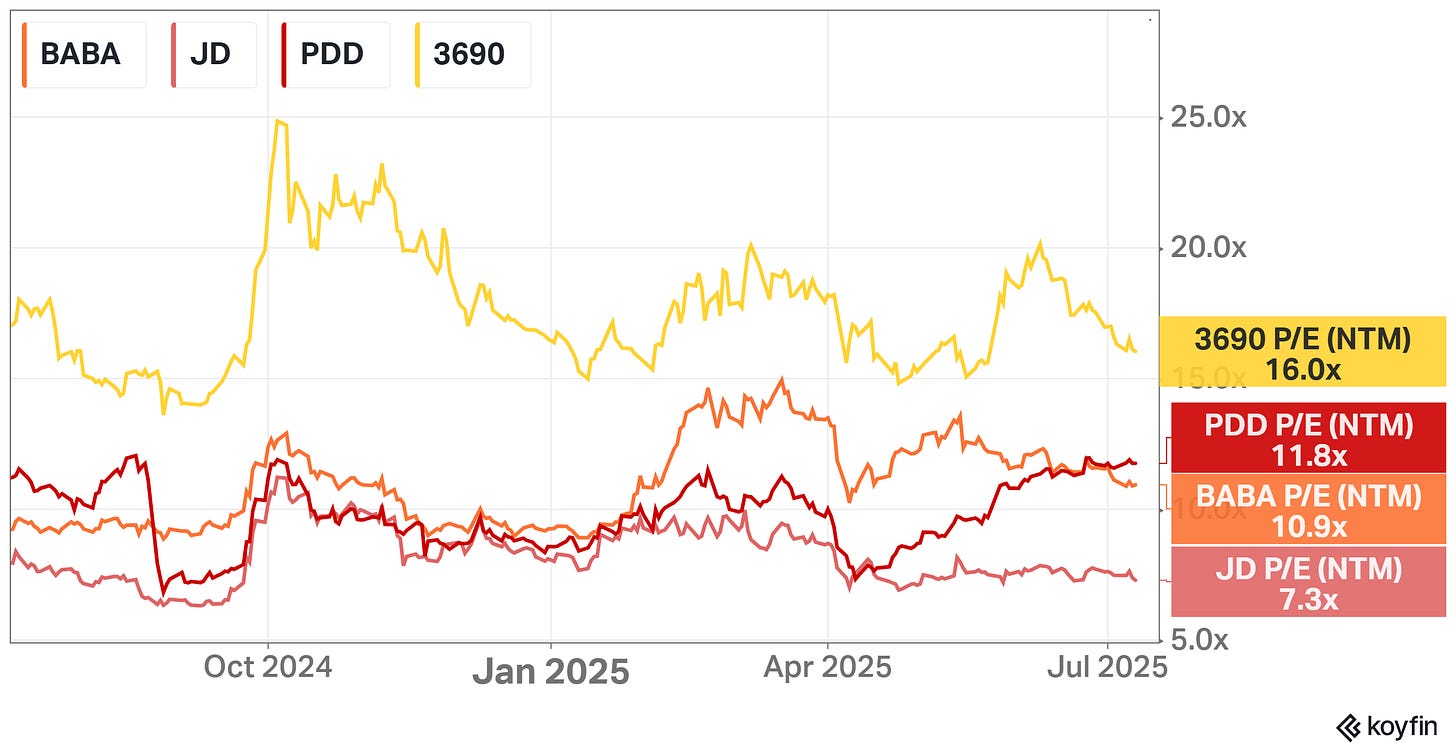

Looking at current valuations (NTM P/E), all major players in the sector are trading at relatively low multiples given their growth potential:

Meituan is trading at 16x earnings, with margins still far from optimized and revenue expected to grow by 15% in 2025.

Pinduoduo sits at 12x, with what I believe are overly conservative estimates, especially over the long term, with revenue forecasted to grow by 9%.

Alibaba trades at 11x, with a 7% growth estimate but strong optionality coming from its cloud business.

JD.com is at just 7x, with projected growth of 12%, partly boosted by government subsidies on home appliances in particular.

So, what happened?

In recent months, the battle over the fast-growing instant delivery segment has intensified, with JD.com entering the market aggressively. Meituan, the current leader, and Alibaba, through Ele.me, have responded with strong countermeasures. A full-blown price war is now underway.

The following slides were created by Tech Buzz China, I highly recommend following their profile on X and subscribing to their Substack.

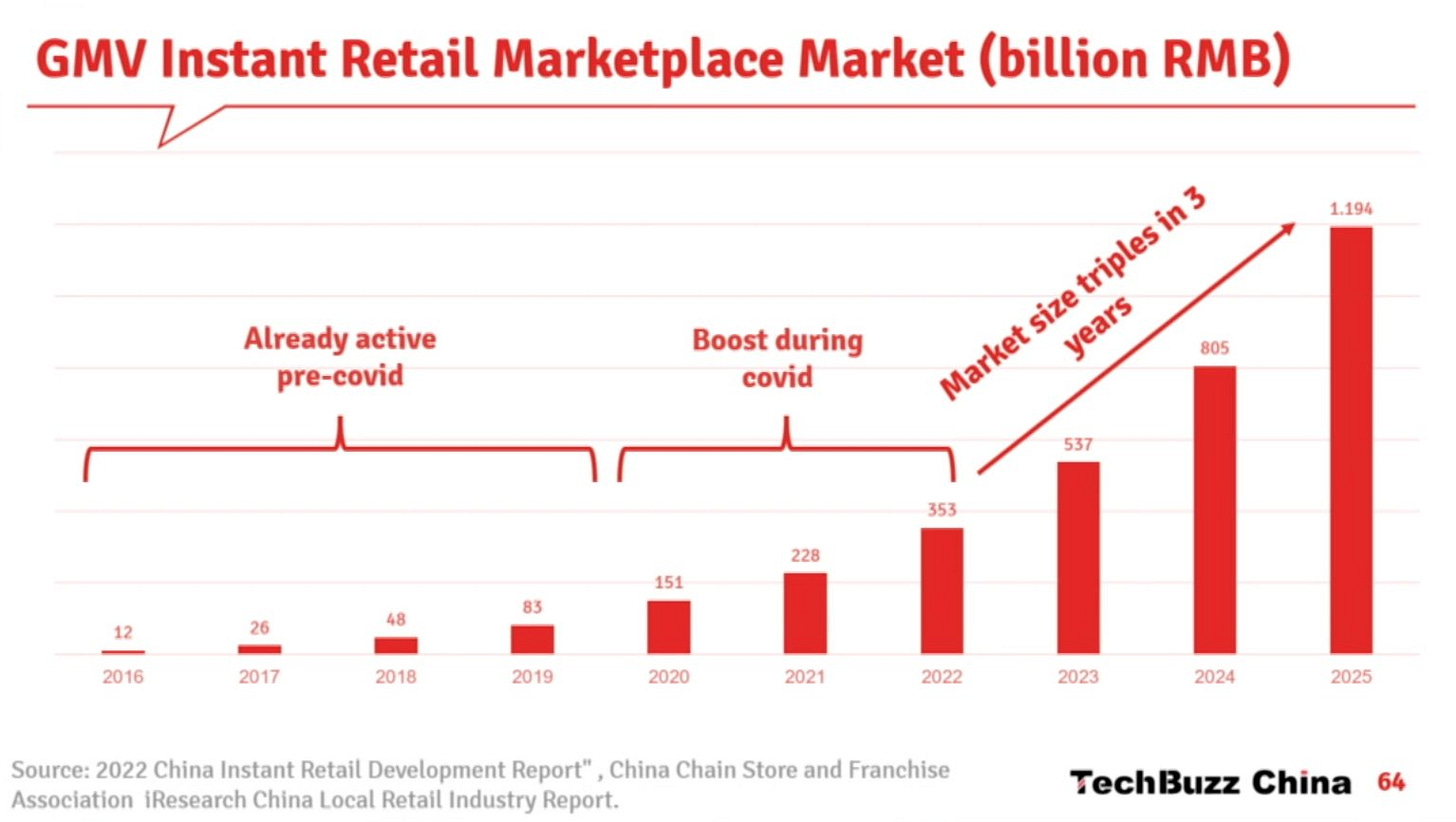

The GMV of the instant retail market, after growing steadily from 2016 to 2022, has absolutely exploded over the past three years, tripling in size and expected to surpass ¥1 trillion in GMV by 2025.

With traditional e-commerce no longer offering high growth rates, all the major players are racing to capture the next big opportunity. Instant retail appears to be the preferred shopping model among younger consumers, making it the obvious strategic focus.

However, this model comes with a cost: it demands heavy upfront investments and prolonged periods of loss-making operations, a dynamic that doesn't sit well with investors looking for immediate profitability.

Rumors are also circulating that Pinduoduo may soon enter the space, following the success of Duoduo Maicai. If that happens, it would be a formidable competitor, armed with nearly $50 billion in cash for bold investments, just as it did with Temu.

Since the beginning of 2025, the number of daily orders in the instant retail segment has more than doubled, surpassing 200 million.

JD.com has already secured a 10% market share, while Alibaba controls around 35%. The remaining 55% still belongs to the market leader, Meituan, which, while continuing to grow, now finds itself in the difficult position of having to defend its dominance, its competitive edge, and the dense delivery network it has built over the years.

Meituan also remains the only profitable player in the space for now. However, management has made it clear they’re ready to do whatever it takes to protect their position, even if that means slipping into the red in the short term.

These concerns, mainly around potential margin compression in the coming quarters, have triggered a broad sell-off across the sector. And this has occurred within an already fragile Chinese market, which has been under pressure for several years now.

How I'm Managing My Exposure to the Sector

At the moment, I'm holding on to my Pinduoduo position (20% exposure) regardless of what's happening in instant retail. I believe their core business still has room to grow, I see huge potential in Temu, and I consider Pinduoduo’s management team the best in the entire sector.

As for Alibaba (10% of My Portfolio), I’m pleased with their recent results, especially in the cloud segment, and I expect their e-commerce operations to continue growing at a 5–10% annual rate.

So I see no reason to sell my position due to the current price war in instant delivery. On the contrary, I’m strongly considering increasing my allocation, given the ever-lower valuations.

Regarding JD.com, while I recognize that the stock is very cheap, I’m not a fan of the business model nor the management team. As a result, I don’t plan to initiate a position there.

Meituan, on the other hand, is a company I intend to study more closely.

It has the chance to prove its strength in this highly competitive space. Its management reminds me of Pinduoduo’s, long-term oriented and execution-driven, and I believe that could make a difference over time.

Valuations also look quite compelling, especially compared to historical levels.

The upcoming Q2 earnings in early August will be key to understanding how margins are holding up, and whether management will share a clearer outlook.

One thing to watch: such an aggressive price war could potentially trigger regulatory intervention in the coming months.

In short, my plan is to continue increasing my exposure to PDD and BABA, where I believe the risk/reward is significantly better than in the U.S. market. Meanwhile, I’ll take a deeper look at Meituan to assess whether it deserves a place in the portfolio.

To dive deeper, I strongly recommend the following readings:

If you enjoyed the reading, please support me with a ❤️ and share it.

Follow me!

Linkedin: Natan Cornaggia

Disclaimer: The information provided in this article is based on my research and is for informational purposes only. It should not be construed as financial advice. Please conduct your research before making any financial decisions. The author is not responsible for any financial losses or damages incurred as a result of following the information presented in this article.

Hi Natan,

Thanks for recommending us.

A few extra thoughts on the topic:

I think PDD has the weakest position if it enters the instant retail sector. It does not have a fleet of couriers, and Duoduo Maicai is next-day delivery, dropping off multiple orders at one pick-up point. JD, Meituan and Eleme all have millions of couriers. Still, PDD might NEED TO enter this space because it is expected that instant retail will start cannibalising traditional retail. That's why JD and Alibaba are doubling down now, because Meituan has been growing very fast through the network of lightning warehouses of its retail partners.

While instant retail won't be profitable soon, especially not when price wars like last Saturday keep breaking out, some experts believe that once warehouse automation and AI, plus autonomous delivery take off and improve efficiency, all e-commerce players will show an even more decisive shift to instant retail. Not counting a longtail of products that are more difficult to deliver through instant retail, consumers are also starting to expect instant gratification and will choose instant retail over traditional e-commerce. Why wait 2 or 3 days (or even half a day with JD) when you can get it in an hour?

Also, be careful with my slide. That was just the results of one day: Super Saturday July 5th. The explosion of orders was the result of heavy subsidising, including milk tea and coffee deliveries.

https://substack.com/@techbuzzchina/note/c-133590912

On normal days, Meituan had about 90 million and Eleme 40 million orders, and Meituan has not lost significant market share since the Eleme/JD orders are incremental and largely coffee and milk tea orders. Nor do I believe it will.

See also my keynote at K5: https://www.chinatalk.nl/video-keynote-the-big-china-update/

Cheers,

Ed