Welcome to Natan's Notes! A quick weekly update on the stocks that I cover, the opportunities I’m exploring, and the thinking behind my portfolio allocation.

Here’s what’s on deck this week:

My biggest position PDD missed by far EPS expectations. What’s going on?

I increased two of my main positions.

To stay updated on future posts, please subscribe and show your support with a ❤️!

My biggest position PDD missed by far EPS expectations. What’s going on?

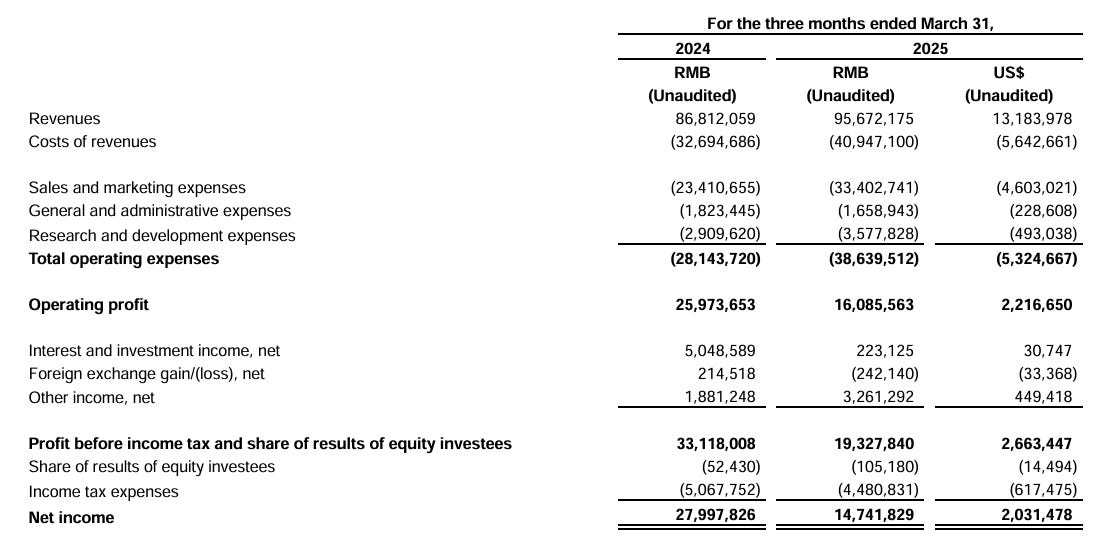

Following its earnings report on Tuesday, May 27, shares of my top holding,PDD 0.00%↑, which makes up 20% of my portfolio, dropped 15% after a double miss. Revenue came in 8% below expectations (RMB 95.7B vs. RMB 103B), and EPS missed estimates by 40% (RMB 11.41 vs. RMB 19.00).

Before diving into the reasons behind these disappointing results, I want to make a few key points clear:

PDD is notoriously opaque in how it communicates with investors and analysts, offering minimal transparency.

The company had already warned, in no uncertain terms during Q2 2024, that earnings would fluctuate significantly in the coming quarters and would likely decline.

“I would like to make it clear to our investors that our profits will gradually trend down starting in Q3, and there will be rebounds in the short term. In the long run, the decline in profitability is inevitable.”

During this week call, management doubled down on their long-term vision, making it clear they don’t care about quarterly numbers. Their focus remains on making the best strategic decisions for long-term success, a philosophy most investors in 2025 aren’t used to, but one I fully agree with.

“However, as stated in our first shareholder letter, we are not a conventional company, and we do not evaluate our strategic decisions based on quarterly financial results. Instead, our focus is on long-term intrinsic value over 5 years, 10 years or even longer. And we believe our long-term investors will share this perspective.”

What if growth hasn’t slowed down?

Here’s what I mean: we only get to see reported revenue, but we don’t have visibility into GMV growth and that’s a big issue.

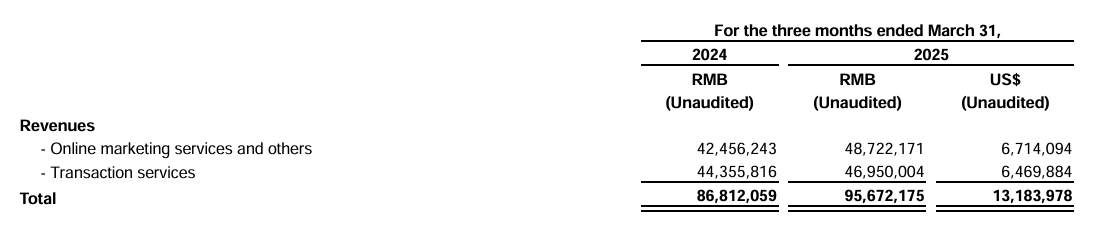

We do know that online ad revenue from the China business grew 15% year-over-year, which is a solid number for a company trading at a single-digit P/E.

Transaction services revenue, on the other hand, grew only 6%, mainly due to Temu’s shift from a fully managed model to a semi-managed one, a change that leads to lower revenue recognition relative to GMV (approximately 15% vs. 40%).

That said, based on third-party reports and several articles I’ve read, it looks like GMV actually grew by at least 20% in 2024 (Source: ECDB) and Pinduoduo continues to gain market share. And honestly, that’s what really matters on a quarter-to-quarter basis: growing the underlying business and strengthening their competitive position.

The huge EPS miss explained

Here’s how the company explained the sharp drop in EPS during the earnings call:

“At the same time, the slowing revenue growth and our continuous ecosystem investments result in a significant drop in profit this quarter. This is mainly due to the mismatch between the business investment and return cycles.”

Keeping in mind that the company isn’t focused on meeting the market’s short-term expectations, the explanation makes perfectly sense.

We can now put everything we’ve seen and heard in recent quarters into perspective:

The new RMB 100B subsidy program to support merchants has inevitably pushed costs higher. At the same time, revenue is growing more slowly due to discounts on advertising, creating a double headwind for margins.

Government-issued consumer vouchers are mainly distributed through 1P platforms like JD, forcing PDD, as a 3P platform, to spend even more aggressively on its own vouchers without directly benefiting from that external tailwind.

Heavy investments in Temu, especially tied to its shift in business model, have likely weighed further on profits. Let’s not forget: this global division is still less than three years old.

Among the various investments mentioned in recent earnings calls, one stands out: headcount is up 35% year-over-year, growing from 17,400 to 23,400 employees.

All these factors are worth monitoring in the next quarters, but given the management’s strong execution track record, I remain confident.

In the next section, I’ll share how I’m managing the PDD position in my portfolio.

To dive deeper, I strongly recommend the following readings:

“The Great Wall Street - Investing in China” update on PDD Q1 2025 results:

I increased two of my main positions

In recent months, especially after the Trump tariff-driven sell-off, I had been increasing some of my U.S. positions, which naturally reduced my China allocation. But given that U.S. companies, at current valuations, generally offer a lower risk/reward, I’m happy to maintain at least a 30% exposure to China.

For that reason, I’ve increased the following positions:

PDD (from 19% to 21% of my portfolio): As discussed earlier, the business is exactly the same as it was before the earnings report. From a long-term perspective, absolutely nothing has changed for me, and I’m happy to take advantage of the discounted price.

On my X profile: nataninvesting, you can find a simplified valuation model with a fair value in the $170–180 range, implying 70–80% upside from current levels, an attractive 25% CAGR return over the next five years.

BABA (from 9% to 11% of my portfolio): I also chose to increase my position in Alibaba after a recent minor pullback. I still see strong potential in the cloud segment, and the core e-commerce business is back to growing at double-digit digit. This position also acts as a hedge in case PDD faces headwinds, since they compete in the same market. I think the new management is doing a solid job, especially by shedding capital-intensive businesses like SunArt. Without those, the company is already growing at double-digit, and it trades at just 11x adjusted earnings.

If you enjoyed the reading, please support me with a ❤️ and share it.

Follow me!

Linkedin: Natan Cornaggia

Disclaimer: The information provided in this article is based on my research and is for informational purposes only. It should not be construed as financial advice. Please conduct your research before making any financial decisions. The author is not responsible for any financial losses or damages incurred as a result of following the information presented in this article.

Good post

Do you bake in your invest thesis multiple expansion? This can be challenging given the long term trend of declining growth rates (that still at acceptable rates don’t get me wrong)