Welcome to Natan's Notes! A quick weekly update on the stocks that I cover, the opportunities I’m exploring, and the thinking behind my portfolio allocation.

Here’s what’s on deck this week:

What does the future look like for Moderna?

My MRNA position is down more than 40%. How am I handling it?

To stay updated on future posts, please subscribe and show your support with a ❤️!

What does the future look like for Moderna?

Over the past year, shares of Moderna, the American biotech company founded in 2010 to develop mRNA-based vaccines and therapies, have been in steady decline. While a series of negative events has understandably weighed on the company’s valuation, there are nonetheless a few potential catalysts worth considering.

The current situation can be summarized as follows: the stock has lost approximately 94% of its value from the highs reached during the pandemic. Yet, the company has built a pipeline of 45 candidates, including 8 assets in Phase 3 and many more in Phase 2, investing over 20 billion dollars in research and development.

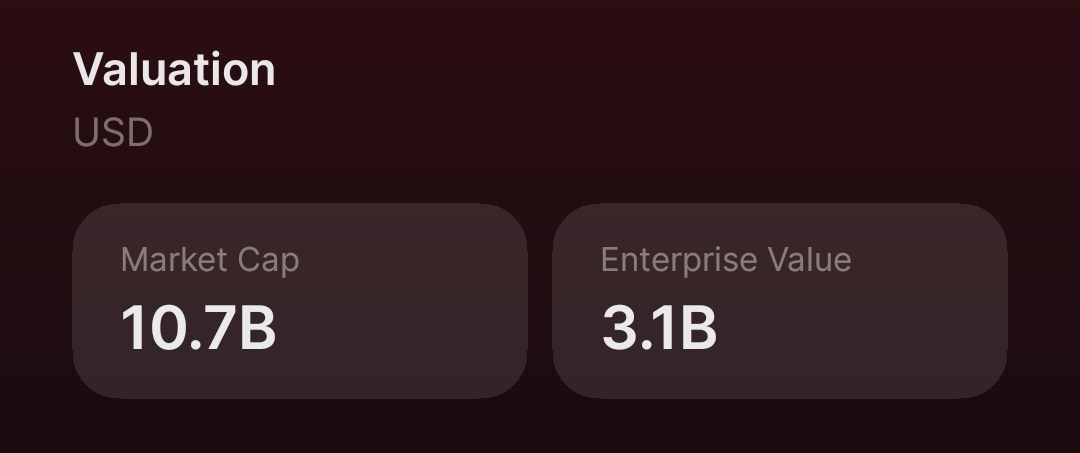

Today’s market cap of $11 billion reflects a deep lack of confidence in the company’s ability to generate future revenue, even though it still holds 8 billion in cash and likely recurring COVID vaccine revenues of around 2 billion.

To explore this further, you can read my Moderna investment thesis, which I still consider valid, even though some of the projections were certainly too optimistic.

The market fears are well-founded

Market fears are numerous as a series of negative events have accumulated, here are some examples:

Specifically regarding the company, Moderna has missed its targets in many quarterly reports due to declining COVID vaccination rates and loss of market share to competitors (BioNTech/Pfizer, Novavax/Sanofi).

The appointment of RFK Jr. to the Department of Health and Human Services was a cold shower. The politician is mostly known for his conspiracy theories and anti-scientific views, particularly against vaccines, so you can imagine the market’s reactions.

On Wednesday, June 11, new members were appointed to the ACIP, a committee responsible for vaccine recommendations in the US. Kennedy fired all previous committee members, a highly questionable decision, and once again, some very controversial figures were included among the members. First and foremost, Robert Malone, who shares Kennedy’s anti-scientific views, also takes advantage of the general public’s limited scientific knowledge to recommend alternative treatments like Ivermectin, whose efficacy has never been proven.

The positive side of the coin

Despite the political headwinds, Moderna’s CEO Stéphane Bancel remains confident about the company’s future.

During the recent discussion at the Goldman Sachs Healthcare Conference, several potential positive catalysts were highlighted, let’s look at the main ones:

The COVID vaccine market could stabilize, partly due to new FDA recommendations that apply to 100 million Americans. In 2024 only 40 million people got vaccinated, which leaves room for a possible increase in vaccination rates.

Moderna’s market share could improve in 2026/2027, by the end of this year new manufacturing facilities will open in Canada, the UK, and Australia, allowing local production. In addition, a supply agreement between the EU and Pfizer/BioNTech will expire in 2027, and Moderna believes it could compete for market share, especially given dissatisfaction in countries like Poland.

Looking at the numbers, the US market could be worth $1.5B for Moderna, and international markets (excluding Europe) another $1B, it’s plausible to expect revenues to stabilize between $2 and $3 billion. Moderna can also leverage its next-generation COVID vaccine, mNEXSPIKE, which has shown improved efficacy in trials.

Regarding other upcoming launches, assuming positive Phase 3 readouts, Moderna remains confident:

Flu: Phase 3 data validating the efficacy of the flu vaccine, also relevant for the COVID/flu combo, is expected soon.

CMV: Phase 3 results are expected in the coming months, although the interim analysis did not show positive signals.

Norovirus: Phase 3 could be completed this year or next, depending on case counts, as with CMV, Moderna would be first to market.

INT: The individualized cancer vaccine program is advancing, with Phase 3 data in melanoma expected in 2026.

As you can see, the list of catalysts is extensive, and at the same time, the company has proven quick to cut unnecessary costs, according to Moderna, the $8 billion in cash on hand is sufficient to reach profitability by 2028, and looking at the numbers, that reasoning makes sense to me.

My MRNA position is down more than 40%. How am I handling it?

To understand how I’m handling the situation, I’d like to return to the initial question: Will MRNA survive?

My answer is clearly yes, and for this reason I’m comfortable remaining invested despite the current loss, my thesis has always been based on the diversification of the pipeline and the numerous Phase 3 trials the company is advancing (the ones I mentioned earlier).

That said, nothing has changed, only the price, the Phase 3 programs are progressing, and their potential value will become clearer over the next 3 to 5 years, the enterprise value currently stands at just $3 billion, and I want to ask you this: is a pipeline of 45 drug candidates, with 9 potential new launches in the next 4 years, really worth only $3 billion? That question isn’t even fully accurate, because the valuation doesn’t take into account the recurring COVID revenue, which I believe could stabilize at a minimum of $2 billion ($8B valuation at 4x sales). In my view, that alone justifies the current $11 billion market cap, without factoring in cash, technology, or pipeline.

What I want to convey is that the current valuation, in my opinion, makes no sense, then again, I understand it, because the market has an extremely short-term horizon, and on top of that, all the recent political developments add further uncertainty.

So, to conclude, I will certainly maintain my position. I’ll also consider increasing it because I remain highly confident in this contrarian idea, even though my allocation to MRNA has fallen to 4.5% due to the price movement and several other investments that have performed well.

Lastly, I want to make it clear that the simple fact the price has dropped does not mean the thesis is wrong, time horizon matters, and mine is definitely not just a few months.

If you enjoyed the reading, please support me with a ❤️ and share it.

Follow me!

Linkedin: Natan Cornaggia

Disclaimer: The information provided in this article is based on my research and is for informational purposes only. It should not be construed as financial advice. Please conduct your research before making any financial decisions. The author is not responsible for any financial losses or damages incurred as a result of following the information presented in this article.

Love your style Natan. Good luck with this. Hopefully they can manage their cash position smartly to allow runway to see that pipeline through!